Letter From The Chair

Jeffrey Snell, IBBA CHAIR

As many of us return from the exciting 2019 IBBA Annual Conference held in Orlando, Florida at the Rosen Shingle Creek this past month, we are receiving many emails and comments about how valuable the Conference was! With over 600 attendees and a record number of exhibitors, thank you for making this one of the largest conferences yet! This year we kicked off the Conference with the BIG FUN Reception that included oversized games and sign spinner entertainment. Our Keynote Speaker Jim Harris spoke on disruption and opportunity, networking ensued at the Main Street Cocktail Party, and Blockchain Seminar brought The Big Ideas Event full circle to conclude the Conference. As part of your leadership, I and your fellow Board of Governors couldn’t be more pleased with the responses we are receiving about your experiences.

Additionally, many have noted that the selection of workshops and masterminds offered were of exceptional value and as a result, are often the breeding ground for new course development.

Regarding educational development, your Education Committee has also been hard at work creating the Business Broker Knowledge Assessment – an online tool that can aid you in determining if business brokerage is right for you and you’re your current expertise level lies. Click here to learn more and take the Knowledge Assessment.

There are also new ways for experienced brokers to earn their CBI designation through the CBI Fast Track Program. Click here for detailed information regarding the CBI Fast Track Program. If your CBI has lapsed, you now have an option to reinstate that is less burdensome and costly than prior requirements. Click here for more information on the reinstatement program.

I hope you were able to attend the 2019 Conference in Orlando, FL and are making plans to attend the 2020 Conference which will be held in Louisville, KY. Watch your email for the latest IBBA news, announcements, and educational opportunities. Looking ahead to next year, get ready to enjoy world class educational courses, workshops, mastermind sessions and networking opportunities!

Until then,

Jeffrey Snell, CBI, M&AMI, IBBA Board of Governors

Make the Numbers Work for You

Jon Brandow, Owner and Principal at BizMiner

Bizminer Company Insights: Make the Numbers Work for You

Prep Sheets and Batch CRM files for 10 million businesses

Evaluating customers or prioritizing prospects? Assessing the stability of a vendor? Determining credit risk? Bizminer’s new Company Insights series provide a unique window into the company you are targeting. Access and share formatted reports of upload batch files to your CRM.

Company Insight reports include three sets of easy-to-digest analytics that are critical to your understanding of the business in question:

- Competitive Industry Market Analysis

- Key Financial Ratio Indicators

- Vestimate® Business Value projection

This unique combination of industry and company intelligence is available for over 10 million US business operations. Data is refreshed monthly.

Here’s what you can learn from Bizminer’s Company Insights:

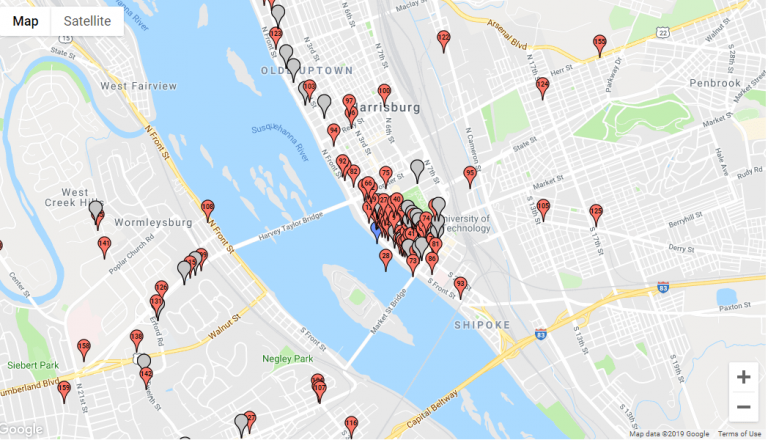

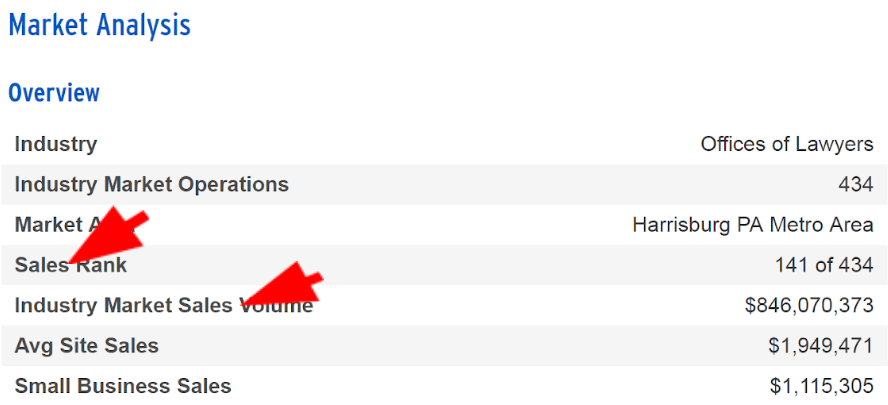

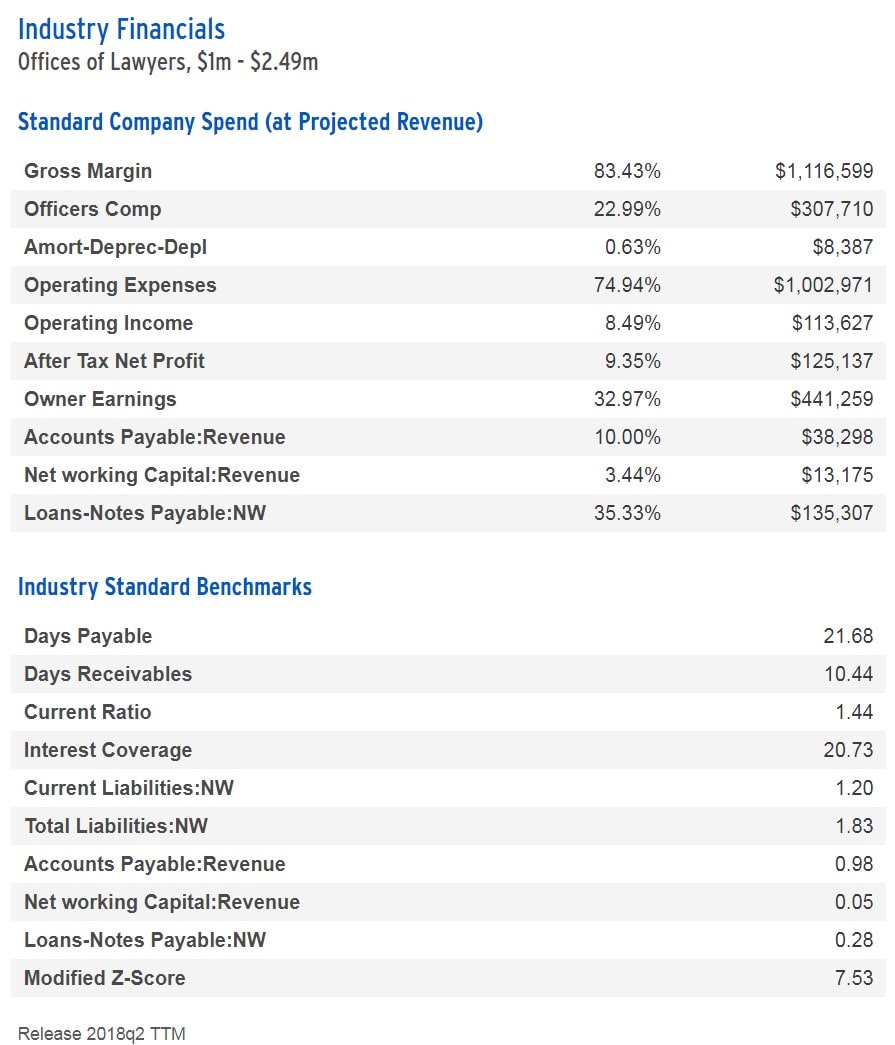

1. Insight into the Competitive Lay of the Land: Market Insights

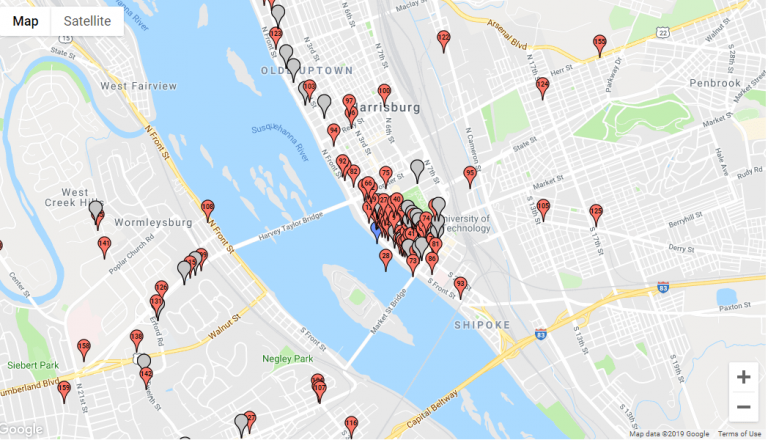

Use the Market Insights segment to help understand the competitive environment of the firm you’re researching. A competitor count and map offer a visual of the geo-positioning of the firm and its competitors.

At the same time, a set of core industry market metrics tells you at a glance how big the market is, as well as average annual site and small business sales specific to the competitive industry environment. Bizminer Industry Insights even rank the sales of your selected firm among those of market competitors.

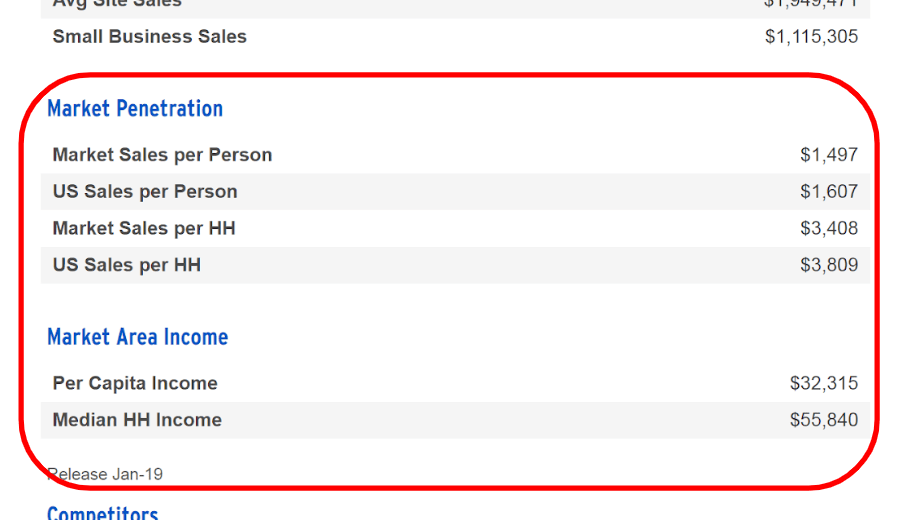

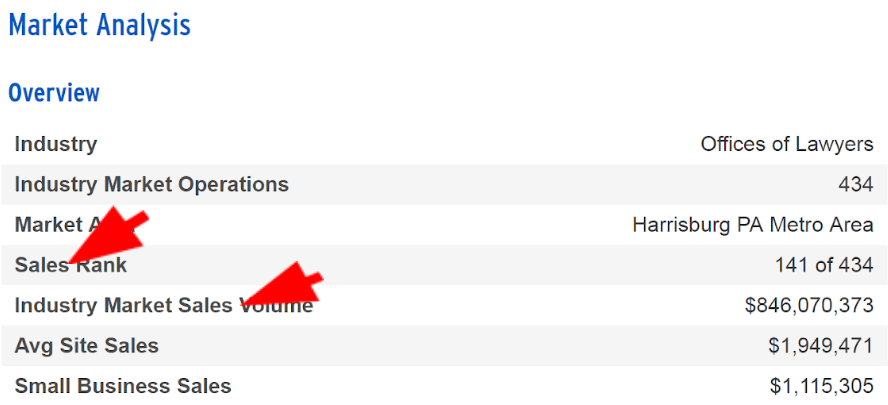

Of course, sales volume isn’t the whole story. The Market Insight Penetration Rates develop indicators of market stability and growth opportunity: Where markets are local or regional, the industry Insight report compares Market Area and US industry Sales per Person and Sales per Household data. Penetration metrics highlight and quantify any gaps in the local industry market relative to US norms.

In the example shown here (a small attorney’s office in downtown Harrisburg, PA) Sales per Person and Sales per Household lag national Market Penetration metrics by up to 11%, suggesting potential service gaps—and growth opportunity for the analyzed firm and the local legal industry overall. Accompanying market area population and income demographics in the market area amplify background opportunity information.

In the example shown here (a small attorney’s office in downtown Harrisburg, PA) Sales per Person and Sales per Household lag national Market Penetration metrics by up to 11%, suggesting potential service gaps—and growth opportunity for the analyzed firm and the local legal industry overall. Accompanying market area population and income demographics in the market area amplify background opportunity information.

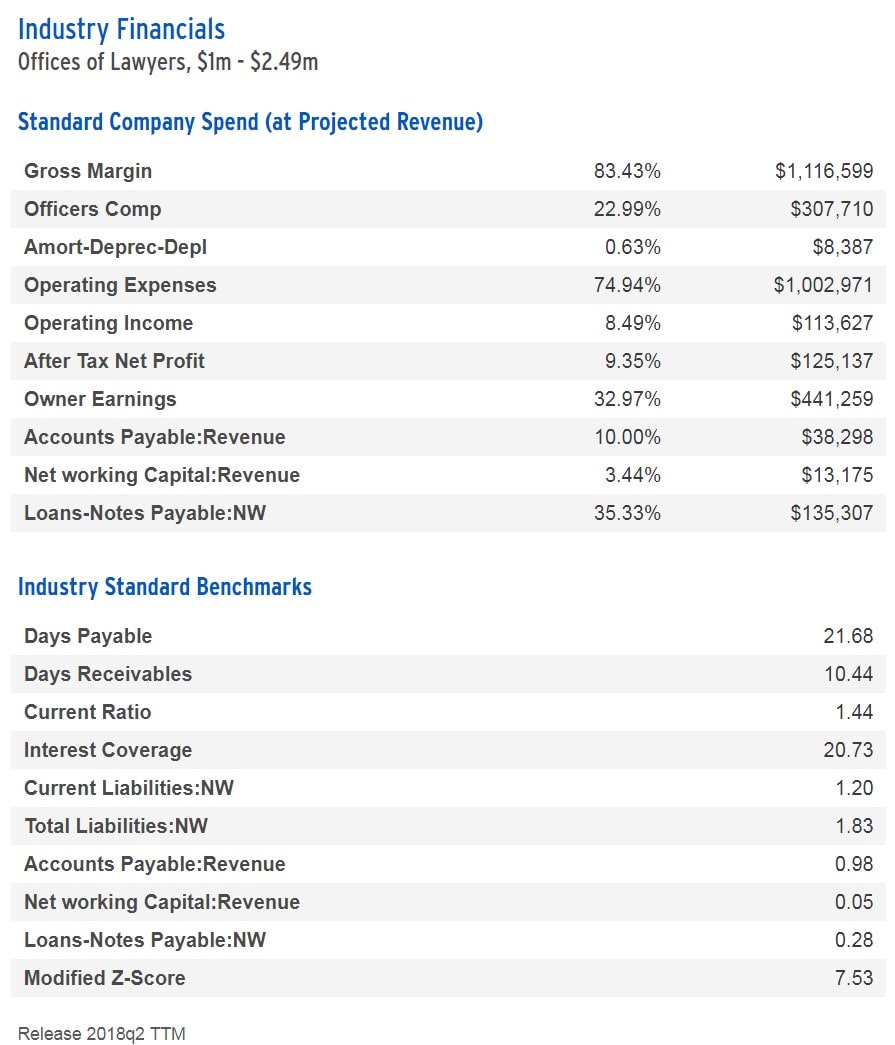

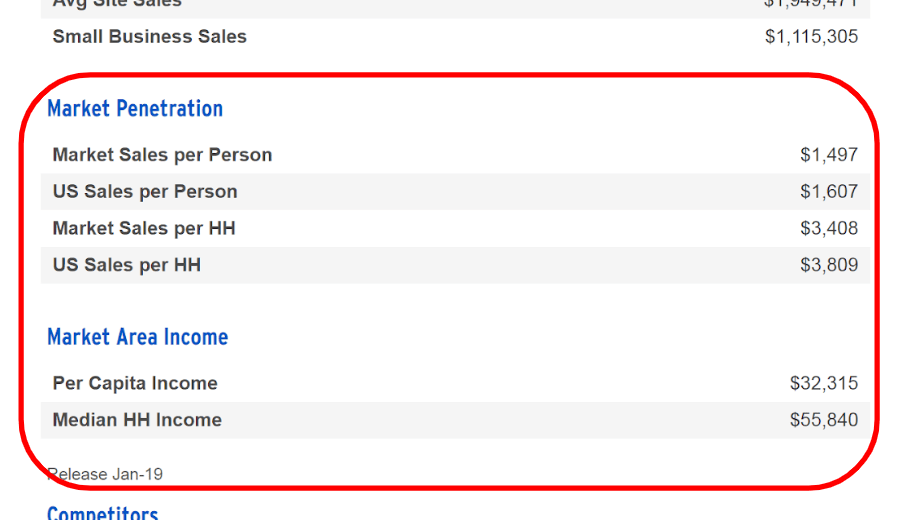

2. Insight into the Business Position: Industry Financial Insights

Why flail around trying to find vaguely applicable financial performance indicators of questionable integrity to compare to the firm in your credit report? Bizminer pulls financial analysis from the most appropriate peer group from over 5000 industry options and 15 sales classes to make certain that the data you see is the most relevant and timely on the market.

Our Financial Insights not only apply apples-to-apples industry peer group performance but quantify the anticipated spend and earnings based on our deeply indexed sales projections for the firm. Bizminer financials are used by more than 30,000 forensic CPAs, business attorneys, banking and certified valuation professionals across the country.

The Industry Standard KPI benchmarks in the Financial Insights segment of the report have been carefully assembled to display the most critical efficiency, liquidity and risk ratios—all tailored to the precise industry and company size you are researching.

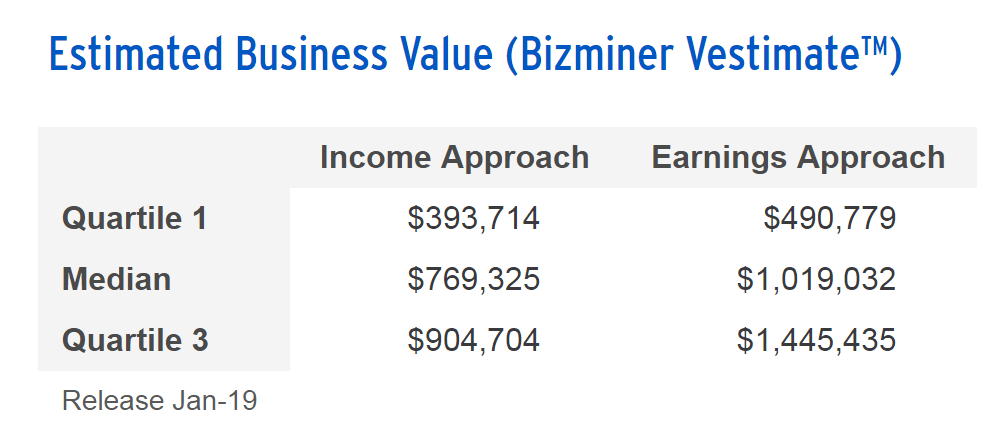

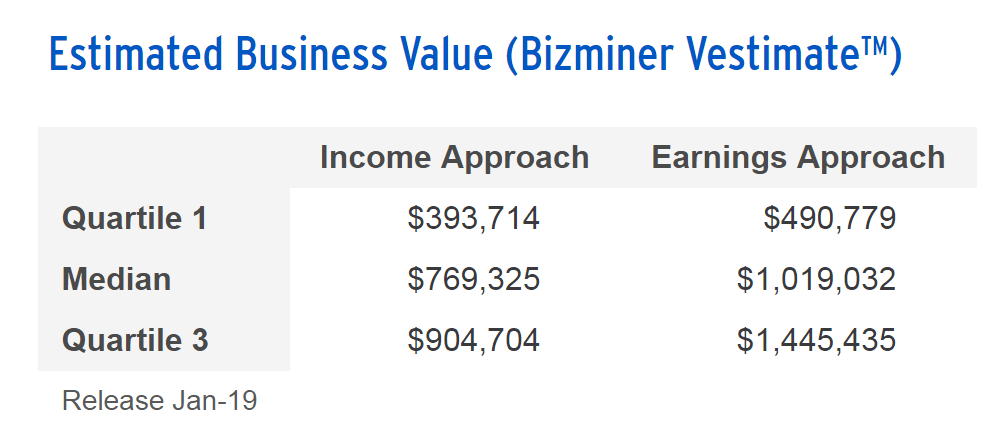

3. Vestimate® Business Value Insights

Finally, the Industry Insights report projects market value ranges for almost any business operation. Using a database of over thirty thousand recent historical business sale transactions, we clean, calculate and apply industry valuation multiples, then integrate them with company sales projections and industry peer group KPIs.

Both Income and Earnings-based value ranges are presented for low-median-high quartiles, with the median values reflecting mid-line company performance. Higher and lower ranges reflect calculations for leading and lagging firms. Like our Market Insights, the value ranges in our Vestimate® Business Value Insights for each business are updated monthly. There is simply no other place to get this range of sophisticated value projection at this price point.

Both Income and Earnings-based value ranges are presented for low-median-high quartiles, with the median values reflecting mid-line company performance. Higher and lower ranges reflect calculations for leading and lagging firms. Like our Market Insights, the value ranges in our Vestimate® Business Value Insights for each business are updated monthly. There is simply no other place to get this range of sophisticated value projection at this price point.

4. Prep Sheet and CRM-Ready Formats

Company Insights are versatile! Print out a one-page prep sheet to spark client conversations and share with prospects—or upload batch files of Company Insights for direct use with your CRM. Co-brand Company Insights to prep and use with clients and prospects. The content in every Company Insight report and file auto-updates throughout your license period.

Easy Access to Data You Can Trust

All of this data—vetted by US Tax Court and by thousands upon thousands of Finserv professionals and other users—is available at a fraction of the value of the information received. Any one of the Industry Insight metric segments—Market, Financial or Vestimate® Business Value—can make the difference in your assessment of any researched firm. Together they provide valuable insights you can’t afford to miss.

Jon Brandow is the founder and principal at BizMiner, the exclusive provider of financial and industry market data services to the International Business Brokers Association. BizMiner provides analytical industry content to 30,000 bankers; thousands of accounting, valuation, CRE professionals and consultants; and over 200,000 business students in almost 100 universities.

Upcoming IBBA Learning Webinar

2019 IBBA Mid-Year Report

Thursday, June 20, 2019

1:00pm ET

Are you interested in learning more about what the IBBA has in store for the future and how the association is performing this year? Join IBBA Chair, Jeffrey Snell, and Executive Director, Kylene Golubski, as they review and discuss the IBBA’s strategic vision, goals and performance. Learn about how far we’ve come and what lies ahead in 2019! We welcome all those in the profession to attend and learn where the IBBA is going in the year ahead, and beyond!

REGISTER HERE

Best Practice Series Launched

The new IBBA Member Resource is here! The Best Practices Series has launched with the release of the first whitepaper, read a sneak peek below:

Best Practices to Improve Confidentiality During a Business Sale

Best Practices to Improve Confidentiality During a Business Sale

Sean Brelsford, CBI

When it comes time to representing your client in the sale of their business, confidentiality is vitally important. You may be dealing with one or more buyers, each of whom will have a multitude of questions and requests and his/her own opinion of how to go about the process of acquiring the business. The potential of a breach of confidentiality drastically increases with time, and once the word gets out, there is no turning back. So how can you, the intermediary, maintain the highest level of confidentiality for your client’s during a sale? This article will navigate you through some steps to help minimize the risk of a confidentiality breach during the sales process.

Log in to the Member Center Resources section to download the full article and look for more Best Practice resources in the coming months.

LOGIN NOW

Going Bare…Or Not

James Frazier, CEO Program Insurance

Going Bare…Or Not

Going Bare…Or Not

Here’s a question for you. Is the sustainability of your practice important to you? An astonishing 70% of professionals in the financial analytical space run without any E&O Insurance. That’s not because they don’t want coverage, but because it can be extremely difficult for them to find a cost effective policy that meets their specific needs.

Fortunately, with Program Insurance (Pi), the cost to fully protect the sustainability of your business is usually less than 1% of your revenues. It all starts with Pi’s three pillars of sustainability: E&O Coverage, Cyber Liability and Protection Coverage, and General Liability Coverage.

E&O = Errors & Omissions

E&O Insurance provides protection for you and your professional services business from claims of negligence or failing to perform your professional duties. Lawsuits, both legitimate and frivolous, are all-too-common these days. Adding E&O to your business insurance portfolio can help protect you from the time-consuming and expensive proposition of mounting a defense if a client takes you to court.

Here’s an example of an E&O claim that we recently dealt with. An M&A firm represented a seller for a sales transaction that seemed to be successful. During the first year after the sale, a major customer of the firm cancelled all of their contracts under the buyer. The buyer sued the seller and M&A firm for misrepresentation and a lack of due diligence. The claim went on for several years resulting in six figure defense costs. The buyer ultimately filed for bankruptcy so the claim died. We are waiting to see if the bankruptcy trustee will open the claim on behalf of the bankruptcy.

Cyber Liability & Protection Insurance

According to a 2017 Ponemon Institute study, more than 61% of small businesses have been hacked, up from 55 percent in 2016. Furthermore, small businesses are now the most likely target of malware and phishing campaigns. That is why there is Cyber Liability and Protection Insurance, or Cyber Insurance. It protects businesses and individuals from Internet-based risks, and more generally from risks relating to IT infrastructure and activities.

Cyber Insurance must have three parts to be effective: breach response, 3rd party liability, and 1st party coverage. The winner by far for 3rd party claims, in frequency and severity, is the transference of malware. This generally arises from an email exchange between a larger company that is doing business with an M&A firm. The M&A firm, unaware that its system has been breached, sends an email with malware attached. Due to the M&A firm being considered “safe” the email sails through the larger company’s firewall, damaging its system or causing customers’ data to be breached. The larger firm’s IT finds the email from the M&A firm that brought in the malware, and the larger company sues the M&A firm for the damage. These claims can be very costly based upon the extent of the damage to the larger firm and it’s systems.

There are many 1st party claims possibilities but reputational damage caused by a breach that leads to loss of business income and profits is generally the claim with the greatest cost attached.

General Liability Coverage

General Liability Insurance coverage protects you, your employees and your business from a variety of claims including bodily injury, property damage, personal injury and others that can arise from your business operations. It has three key parts: premises and operations insurance, personal injury coverage, and host liquor liability.

The most common personal injury claim we have seen in the M&A and Business Brokering area involves being sued by a competitor or by a prospective buyer for liable and slander.

The premises and operations section of General Liability coverage provides protection for a fairly wide array of situations. One claim involved an employee who left a space heater on and caused a fire that damaged the landlord’s building and other tenant’s property.

A host liquor liability claim could involve an M&A firm hosting an office party to celebrate a big closing and someone leaves the party, drives while intoxicated, and causes an accident. Many states hold the “host” providing the alcohol to be held responsible just as a bar would be.

Going Naked… Or Not

Is it sound decision-making to self-insure or “go naked” when the right insurance protection is usually less than 1% of your revenues? At Program Insurance, we boast a 94% quote-to-close rate alongside a 99.7% retention rate. This means that not only do potential policyholders like what we have to offer and choose us over other companies, but current policyholders trust us so strongly with their coverage that they choose to stay with us year after year. Why not find out how Program Insurance can improve the sustainability of your practice?

James Frazier has been serving individuals and businesses with insurance coverage since 1980. A master craftsman and consummate advocate for his clients’ business success, he enjoys interacting with professionals, discovering the unique nuances of their firms and custom-tailoring insurance policies that help cover and sustain them over time.

Fresh Off The Press

Congratulations to our 2019 IBBA Member Excellence Award Winners!

International Business Brokers Association

Recognizes the Best in the Industry

Fifty-one business brokers from throughout the world received awards of excellence at the International Business Brokers Association (IBBA) Member Excellence Awards Gala during its annual conference in Orlando, Fla. on May 11.

“This is an outstanding group of business brokers and true leaders in the industry,” said Jeffrey Snell, IBBA Board Chair and Chief Governance Officer. “We’re pleased to recognize and honor their high standards of skill and excellence which the IBBA strongly promotes.”

READ THE FULL PRESS RELEASE

Buyers: Who, What & Why

LISA RILEY, CBI, CBB, PhD

Buyers: Who, What & Why

Buyers: Who, What & Why

Do you know who is likely to purchase the business you just decided to sell or you received an Engagement Agreement? Are you targeting the appropriate buyers? The Q1 2019 Market Pulse Survey* reveals that, on average, advisors receive about 25 unqualified buyer inquiries per engagement. In order to understand where your marketing dollars are best spent and the likely buyer of this business, you’ll need to understand who the likely buyer is, what industries have greater likelihood of buyers purchasing and why the buyer is buying the business.

Who: Type and Location of Buyer

For those who do end up buying a business, almost half of the businesses sold for <$500,000 were to first time buyers. For those in the $2MM to $5MM purchase price, existing companies were the major buyers.

<$500,000: Buyers in this sector tend to be:

- First time buyers (49%), serial entrepreneurs (30%), or existing companies (19%)

- Located within 20 miles (68%) or more than 100 miles (14%) of the seller’s location

$500K-$1MM: Buyers in this sector tend to be:

- First time buyers (42%), existing companies (33%), serial entrepreneurs (19%)

- Located within 20 miles (60%) or more than 100 miles (19%) of the seller’s location

$1MM-$2MM: Buyers in this sector tend to be:

- Existing companies (34%), serial entrepreneurs (34%), or first-time buyers (21%)

- Located within 20 miles (48%) or within 100 miles (28%) of the seller’s location

$2MM-$5MM: Buyers in this sector tend to be:

- Existing companies (45%), first time buyers (25%), or serial entrepreneurs (15%)

- Located within 20 miles (40%) or more than 100 miles (35%) of the seller’s location

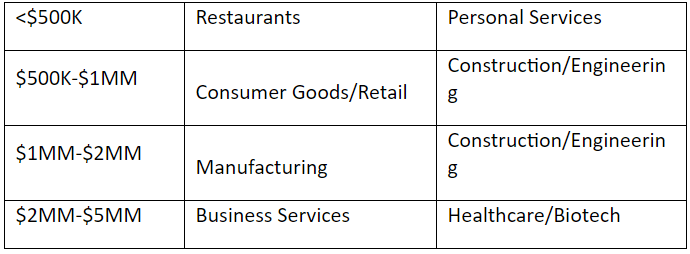

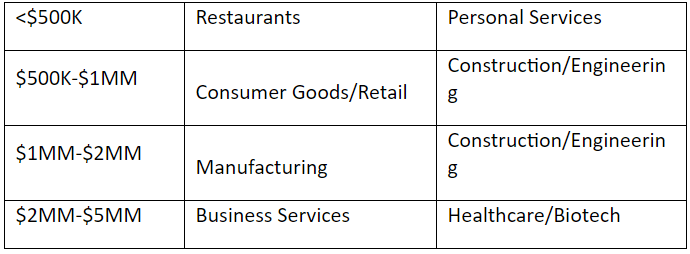

What: Top Industries

In the Main Street Market, buyers are primarily buying restaurants and personal services. In $1MM-$2MM purchase price, manufacturing, construction, and engineering are dominating industry transitions, whereas buyers in the $2MM-$5MM range are focused on business services, and the healthcare/biotech industries.

Figure 1: Top Industries by Market Sector

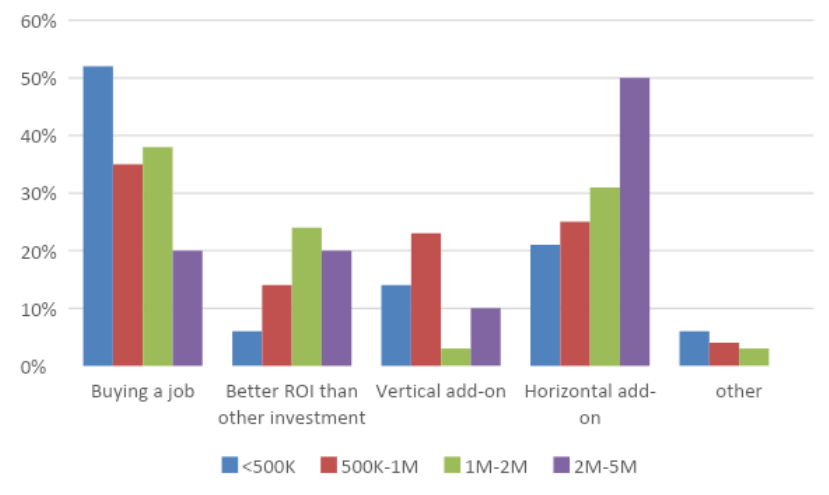

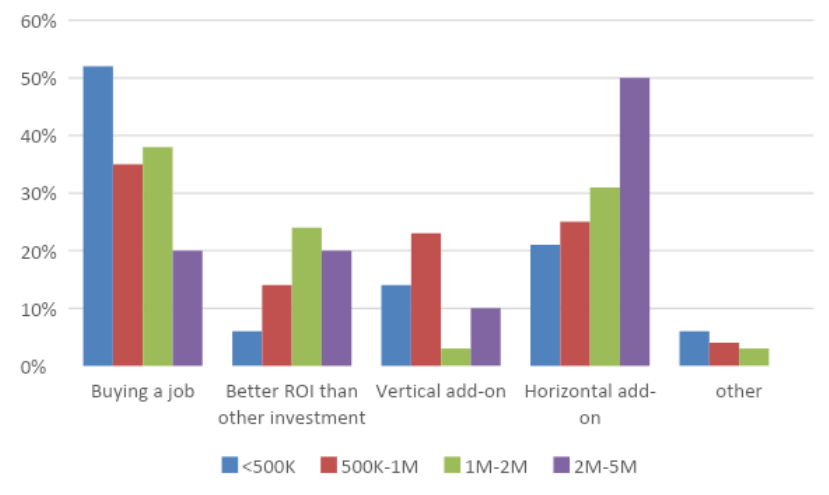

Why: #1 Motivation

Buy A Job: Over half (52%) of Buyers who purchased a business for <$500K were buying a job as were just over 1/3 of those in the >$500K-$1MM (35%) and $1MM-$2MM (38%).

Gain Horizontal Add-On: Half of the buyers who purchased in the $2MM-$5MM (50%) did so to acquire a business operating at the same level of the value chain in a similar or different industry, whereas approximately 1/3 (31%) of those who purchased a $1MM-$2MM business and ¼ of the $500-$1MM.

Figure 2: #1 Motivation for Buyer

Now that you know the likely buyer and their motivation, you can target that buyer. Ideally, this will lead to more qualified inquiries and lesson the number of unqualified buyer inquiries.

*The quarterly IBBA and M&A Source Market Pulse Survey was created to gain an accurate understanding of the market conditions for businesses being sold in Main Street (values $0-$2MM) and the lower middle market (values $2MM -$50MM). The national survey was conducted with the intent of providing a valuable resource to business owners and their advisors. The IBBA and M&A Source present the Market Pulse Survey with the support of the Pepperdine Private Capital Markets Project and the Pepperdine Graziado Business School.

The Q1 2019 survey was completed by 292 business brokers and M&A advisors. Respondents completed 257 transactions this quarter, the 28th edition of this quarterly report.

Lisa Riley is the Owner and Designated Broker at LINK Business-Phoenix in AZ. Lisa is a Certified Business Intermediary [CBI], a Certified Business Broker [CBB], Certified Mergers & Acquisitions Professional [CM&AP], PhD, Chair of Market Pulse Committee and Board Member of the International Business Brokers Association [IBBA] and the Arizona Business Brokers Association [AZBBA], as well as a former business owner and university professor. She can be reached at 480-686-8062 or [email protected]. LINK Business-Phoenix provides services for business transitions from valuation throughout the sales and transition process to final sale/exit or acquisition. LINK Business is an International Business Brokerage Franchise providing services with locations throughout the US, Australia, New Zealand and the Philippines.

Upcoming Educational Summits

Fort Lauderdale, FL | July 22-24, 2019

Cleveland, OH | August 25-27, 2019

Westborough, MA | September 11-13, 2019

REGISTER HERE

Q1 2019 Market Pulse

Executive Summary

The International Business Brokers Association and M&A Source, in partnership with Pepperdine Private Capital Markets Project, have set a goal to provide quality information on a quarterly basis in order to become the go-to source for Main Street and Lower Middle Market transactions.

DOWNLOAD HERE

Prepare for the Unexpected

Erica Lewandowski, CBI

Prepare for the Unexpected

Prepare for the Unexpected

If you’ve been a business broker for more than a few years, you know we play a long game. We may work with a client for years before they are ready to sell. Most business owners know they will eventually want to sell, but they don’t have a concrete exit strategy. Most business owners think they will sell at a certain age, and a buyer will be ready and waiting to fully fund their retirement. Many want to continue working as long as they can and don’t want to consider the possibility that at some point, working will no longer be possible. They certainly aren’t prepared for an emergency sale in the event something should happen to them and their loved ones need to step in.

As a trusted advisor, it’s our responsibility to help our business owners understand and plan for life’s unexpected turns. Do your business owners know what would happen to their business if the unexpected suddenly happens? Would their loved ones know what steps to take or who to call if an emergency were to arise and the owner is suddenly unable to run the business? Would their loved ones need to sell the business, and would they know who to turn to for help?

Part of being a trusted advisor is to help your clients understand the importance of working with a business broker several years in advance of their desired exit date. For a business owner, always knowing the value of the business, and having an accurate valuation readily available, is an important step in perpetuation planning. As an experienced broker and valuator, you are in an ideal position to not only value their business, but also review their financials annually and recommend changes that may improve their profitability. By updating a valuation annually, you have the opportunity to build a relationship with the owner and help identify and resolve any concerns that may hinder the sale of their business before it is time to sell. In the event of an unfortunate tragedy, the business owners’ loved ones will already know the value of the business and they will know who to call for help with the sale. As the valuator and broker, you will have all the information you need to take the business to market quickly.

As you approach these topics with your owners, you might want to share this checklist with them to be sure they are preparing appropriately for the unexpected. If you can find one business owner a month and start this process with them, you will not only have an income source from valuation work, you will have built a lifetime of future clients.

Preparation Checklist

– Build your team of professionals and meet with them annually

- M&A Advisor

- Accountant/CPA

- Financial Planner

- Attorney

– Work with your Business Broker/M&A Advisor to complete a valuation of your business

– Work with your financial planner

- Calculate proceeds of sale and create financial plan

- Develop a state and federal tax plan strategy

– List assets for business

- Most recent annual Business Valuation

- List of Cash Accounts

- Descriptions of all Real Estate

- List of equipment

- Documentation for any other business assets

– Bank Statements

- Operating account monthly statement

- Trust account monthly statement

– Financial documents – Work with accountant and have this information readily available

- Annual and monthly Profit and Loss statements

- Annual and monthly Balance Sheets

- Promissory notes, commercial paper, loan or credit agreements, and letters of credit

- All federal and state tax returns (3 years)

- Employment tax filings

– Real Estate related documents

– Employee information

- Organizational Chart of business

- Specific employee information

- Length of time employed

- Actual employee or contractor agreements

- Form or template employee agreements in use

- Compensation plan details

- Existing employee non-compete agreements

– Daily management items – Keep items current and updated

- Computer systems, banks, management systems, etc.

- List of investment, retirement, and bank accounts with all contact information

- List of debt obligations, due dates, and contact information

- Copies of any credit agreements (leases, mortgages, financing documents, etc.)

– Personal Items

- Wills

- Durable Power of Attorney and Living Wills

- Legal documents (birth certificates, marriage license, divorce papers, passports, etc.)

- Safety deposit box key

- Titles (motor vehicles, etc.)

- Receipts for major purchases (for warranty and insurance purposes)

- Deeds to any real estate

- Current insurance policies and contact details

- Personal bank account information and contact information

- Personal investment account information and contact information

- Emergency contact information

- Attorney

- Accountant

- Financial Planner

- Business Broker/M&AMI Advisor

- Insurance Contact

- Immediate family members

Erica is an active member of the International Business Broker Association (IBBA), Florida Association of Insurance Agents (FAIA), and Latin American Association of Insurance Agencies (LAAIA). Erica’s success is a direct result of her ability to build quality relationships, provide exceptional service, and find solutions to her clients’ unique challenges, ultimately helping them to thrive in their pursuits.

DID YOU KNOW?

Did you know you can search for a Business Broker including their Specialty Areas?

Use the Find A Broker search tool HERE!

INDUSTRY SPOTLIGHT: IBBA has over 400 Business Brokers that specialize in the Manufacturing!

CERTIFICATION IS YOUR ADVANTAGE.

Learn more about the CBI HERE!

When you want to work with the best intermediary to buy or sell a business, look for the CBI designation.

GET ENGAGED!

We invite all IBBA Members to join the IBBA Facebook and IBBA LinkedIn Member Groups! Use these as a tool to communicate with your peers to get conversations started to get engaged!

TAKE ME TO FACEBOOK

1. LIKE the IBBA Facebook page.

2. REQUEST to join the IBBA Private Group.

3. Once approved, START a conversation!

TAKE ME TO LINKEDIN

New Member Section

Welcome to 100+ New Members that joined the IBBA since March 1, 2019!

IBBA Member Benefits

To get started with your FREE access, login to your IBBA Member Account to get access from each benefit partner:

Bizminer

Business Reference Guide Online

ValuSource

Get Connected to the IBBA!

In the example shown here (a small attorney’s office in downtown Harrisburg, PA) Sales per Person and Sales per Household lag national Market Penetration metrics by up to 11%, suggesting potential service gaps—and growth opportunity for the analyzed firm and the local legal industry overall. Accompanying market area population and income demographics in the market area amplify background opportunity information.

In the example shown here (a small attorney’s office in downtown Harrisburg, PA) Sales per Person and Sales per Household lag national Market Penetration metrics by up to 11%, suggesting potential service gaps—and growth opportunity for the analyzed firm and the local legal industry overall. Accompanying market area population and income demographics in the market area amplify background opportunity information.

Both Income and Earnings-based value ranges are presented for low-median-high quartiles, with the median values reflecting mid-line company performance. Higher and lower ranges reflect calculations for leading and lagging firms. Like our Market Insights, the value ranges in our Vestimate® Business Value Insights for each business are updated monthly. There is simply no other place to get this range of sophisticated value projection at this price point.

Both Income and Earnings-based value ranges are presented for low-median-high quartiles, with the median values reflecting mid-line company performance. Higher and lower ranges reflect calculations for leading and lagging firms. Like our Market Insights, the value ranges in our Vestimate® Business Value Insights for each business are updated monthly. There is simply no other place to get this range of sophisticated value projection at this price point. Best Practices to Improve Confidentiality During a Business Sale

Best Practices to Improve Confidentiality During a Business Sale Going Bare…Or Not

Going Bare…Or Not

Buyers: Who, What & Why

Buyers: Who, What & Why

Prepare for the Unexpected

Prepare for the Unexpected