IBBAinsights: Summer 2024

IN THIS ISSUE: “Embracing Our Legacy, Shaping Our Future” Letter from the 2024 IBBA Chair. Plus, Insights on Finding Success, Overcoming Blindspots, the Latest Legislative Update, and more!

The IBBA is excited to roll out the Market Pulse Quarterly Survey! Take five to seven minutes to complete this survey and help the IBBA get recognized on a national scale. Your participation will not only enhance the quality of the results but will also allow you to access valuable insight into the current marketplace environment.

There is still time to register for the M&A Source Fall Conference! Register now before rates increase again on October 26th!

Pino Bacinello, CBI, M&AMI, CMEA, CSBA

With Canadian Thanksgiving just behind us in Canada, and in the advent of American Thanksgiving, I am compelled to talk about how grateful and thankful I am for being in this profession, for having had the opportunity to have met and learned from so many of you and for having been able to serve you as the Chair of the Board of Directors.

I am both grateful and thankful and want to briefly talk about the difference between the two.

Grateful means appreciating what someone has done and wishing to express a thank you, while being thankful means feeling relieved or pleased, or feeling blessed that what one hoped had actually happened or what one was afraid of did not happen.

That being said, I am grateful and appreciative of having being given the trust and opportunity to serve in this great and truly international organization, as well as what so many members of this great association have done for me. They have helped me garner the knowledge I have today and build the practice I have. I am thankful that I managed to survive what the recent economic environment has thrown at all of us. I am also very grateful to our many volunteer board and committee members who have given up so much to help us get through what in January seemed to be so overwhelming.

I am pleased to announce that the advisory committee proposed back in January called the IBBA Presidents Council made up of past Presidents and Chairs of IBBA is now in place. Jeffrey D. Jones, ASA,CBA,CBI will serve as the first chair of the council. The following past presidents and chairs have agreed to serve on the council:

[ezcol_1quarter]

Andy Cagnetta

Brian Knight

Edwin Lee

Fred Zirkle

[/ezcol_1quarter]

[ezcol_1quarter]

Henry Hicks

Jeff Jones

Jim Afinowich

John Johnson

[/ezcol_1quarter]

[ezcol_1quarter]

Julie Johnson

Linda Purcell

Michael Hoesly

Rob Firestone

[/ezcol_1quarter]

[ezcol_1quarter_end]

Ron Chernak

Ron Johnson

Tom West

[/ezcol_1quarter_end]

Please reach out to them to not only thank them for their commitment of time, but also to provide your input, ideas and needs to them as this group will be providing feedback to your Board and Board Chair to help better serve you.

Wishing you all a productive and deal flow-filled Fall!

We would like to recognize the following Founders of the IBBA:

Don McIver, Jeff Jones, Tom West, Barbara West, Bill Womack, and Connie Womack-Zielinski

The Board of Directors recognize the efforts of Founders Bill Womack and Connie Womack-Zielinski by serving each of them with a “Lifetime Membership” to the IBBA. Also recognized is Barbara West, with the first ever bestowment of Honorary Member of the IBBA.

The actual presentation will take place at the joint IBBA and M&A Source Spring Conference, to take place in Anaheim, California, June 10th through the 15th, 2013. Please join us in congratulating Bill, Barbara, and Connie, in addition to Tom, Don, and Jeff, for their great efforts in creation of this great association!

Karl Kirsch, CAE

At Meeting Expectations, our priority is transitioning the IBBA and M&A Source to a new database and website, as well as prepare for the renewal season. Even though we will be handling renewals without our new system in place, we trust that once these changes occur, operations will run smoother than ever. As a company, we have recently received two honors, both in our industry and in the community, that prove we are more than equipped for the task ahead.

At Meeting Expectations, our priority is transitioning the IBBA and M&A Source to a new database and website, as well as prepare for the renewal season. Even though we will be handling renewals without our new system in place, we trust that once these changes occur, operations will run smoother than ever. As a company, we have recently received two honors, both in our industry and in the community, that prove we are more than equipped for the task ahead.

For the second consecutive year, Meeting Expectations was named one of Atlanta’s “Best Places to Work” in the Atlanta Business Chronicle’s annual survey, landing at number 18 in the small business category (10 to 100 employees in Metro Atlanta). The results are based on an annual employee satisfaction survey conducted by Quantum Workplace. Meeting Expectations credits its fun and supportive culture that inspires employees to go above and beyond for customers and each other, in addition to the company’s unique mix of benefits, frequent social events, and a generous paid time off policy.

In addition to this honor, we were also named to Corporate Meetings & Incentives 2012 “CMI 25” list for the sixth consecutive year. The CMI 25 list is an annual directory of the largest and most influential full-service meeting and incentive travel management companies focused on the corporate meetings and events industry. Several factors were considered when selecting the companies for the list, including the number of meetings and incentive travel programs managed in 2011, and the percentage of the company’s revenue that came from organizing corporate meetings and incentives. As a full-service conference and association management company, our staff—including several Certified Meeting Professionals (CMPs)—creates corporate events such as customer summits, franchise conventions, and other corporate educational conferences all over the world.

These two recognitions are a testament to the hard work and dedication at Meeting Expectations. We are proud to bring this precedent of success to the IBBA.

Thank you for selecting Meeting Expectations to partner with you. We’re excited that we have teamed up with the IBBA and M&A Source, and we look forward to many great things to come in the future.Please let our staff members here at headquarters know if there is anything we can do to assist you.

Chet Walden, CBI, M&AMI, BCI, FIBBA

You asked, and we listened! You’ve asked for more educational classes at the M&A Source Fall Conference, and we added an extra one just for you on Friday afternoon.

You asked, and we listened! You’ve asked for more educational classes at the M&A Source Fall Conference, and we added an extra one just for you on Friday afternoon.

Our new “Subtle Art of Educating the Client” class got great reviews in San Antonio. If you would like to learn some additional techniques for building your practice, getting clients to the table, showing and proving the client your value, and collecting development fees on the front end, this class is for you.

Click here to find out more about the conference, where you can network with other intermediaries and attend workshops to learn from industry experts.

We look forward to seeing you there!

Chet Walden, CBI, M&AMI, BCI, FIBBA

Chairman M&A Source

Scott Bushkie, CBI, M&AMI

It is survey time again! Please take 5-7 minutes to fill out the Market Pulse Q3 Survey. It is very important you all fill this out, as we need to hit a certain number of responses in order for the bigger media outlets to pick up the story. This is how we are going to continue to build our brand in the eyes of the business owner and their advisers. You, as a member of the IBBA, will be the local expert for people to turn to.

It is survey time again! Please take 5-7 minutes to fill out the Market Pulse Q3 Survey. It is very important you all fill this out, as we need to hit a certain number of responses in order for the bigger media outlets to pick up the story. This is how we are going to continue to build our brand in the eyes of the business owner and their advisers. You, as a member of the IBBA, will be the local expert for people to turn to.

The results of the first quarterly report was picked up by some national and local media networks. More responses would only ensure more media attention. If you still have not seen the executive summary results, or the full 70-page report, please contact [email protected]. This will be the only time you will get access to the 70 page report without completing the survey.

Continued success,

Scott Bushkie, CBI, M&AMI

Marketing Committee Chair

Steve Wain, CBI, M&AMI

Setting Up a Modern Brokerage Practice, Part 3

For the last two months, we’ve discussed issues that affect business brokers and intermediaries in utilizing modern technology to improve their practices. These additions, some of which are readily available to you on your computers, phones, and tablets, are both inexpensive and can lead to better productivity.

For the last two months, we’ve discussed issues that affect business brokers and intermediaries in utilizing modern technology to improve their practices. These additions, some of which are readily available to you on your computers, phones, and tablets, are both inexpensive and can lead to better productivity.

Invariably, when I am cornered by brokers and intermediaries, I get asked to answer the mother of all tech questions: “What CRM system should I use?” It is a tough question to digest, and an equally tough question to answer.

First, if you don’t know what CRM stands for, it is Customer Relationship Management. The whole concept of CRM systems began in the 80’s with the advent of more automated computer systems. A CRM system was initially like an automated rolodex but has evolved over time to do many things. Central to this has always been keeping information about your customers and prospects readily available.

Many systems have been developed. Some are the stalwarts, and some are new guys on the block. Invariably, they all try to address the same things. With all the bells and whistles, the real question comes down to what is best for the broker and their practice. We will try to address some of those questions here, and give you a glimpse of solutions that may be worth your time to further investigate.

First though, let’s answer what a CRM system should do for a broker. The areas to concentrate on are:

Another important factor is the community of people who use it. As can be seen by any product that is in widespread use, when many people adopt something, others are sure to show up offering enhancements, training, and management. It is a safe bet to assume that any system that houses prospect and customer information will undergo requirements for change over time. When you are evaluating a solution for yourself, consider how responsive the developer is to updates, service, and whether the at-large community is vocal and supportive of the product. This is a key factor – do not underestimate its value to you. Conversions to new and better systems can be fraught with problems and cost you a lot of time and money.

The last two components to consider are somewhat connected but have different implications. The first is delivery method. In many cases, most of the newer systems being offered are delivered via the ‘cloud’. For those who have heard of the cloud but don’t know what it is, it is just a means to offer services using the internet, and without your assistance in maintenance and upgrades. Companies that purchase solutions via the cloud look to save money by having limited IT staff, no requirements to house expensive equipment, supporting systems, and costs that go along with that. To a great degree, it’s the lease vs. own model. When you use the cloud, you just, well, use it. It’s there for you typically 24/7 just by going to a website, logging in, and you have access to your systems and information. The developer/supplier takes care of all operations, updates, and backups. For you, you just pay for use of the service on a month-to-month or year-to-year basis, usually based on the number of users you have accessing it.

The second delivery method is to own the license for the use of the software. Unlike the Cloud approach, you typically buy a perpetual or longer-term license, and then run it on your own hardware and supporting software systems. You have no ongoing costs except possible upgrades and external support.

What is better for you? That’s your choice. Over time, the costs can vary substantially. Now, many internally based systems also have some mechanism to offer cloud support for remote users at little to no-cost above the price of the initial license fee. This gives you the best of many possibilities.

The last component is price. Let’s be honest, we all want to have everything for as little as possible. Given the characteristics of our industry, many sole practitioners and small shops will say price is the biggest factor in selection of a solution. Although logically it shouldn’t be, I truly understand the pressure to select a viable and less costly solution. Lucky for all, the solutions that exist now, both in self-managed and cloud based systems are not very costly, and in the long-term, will provide much more value than they cost you if you evaluate their benefits.

In our M&A practice, we have over 10 users, and the costs for us to use a well-known system that we have customized and manage on our own server have been determined to be more economical than a completely cloud based systems. Our system also has cloud capacity, which gives us complete flexibility. But, over time we determined that since we have the functionality we need, we chose to manage it ourselves and save money. For other companies I know, they don’t want anything to do with a system that they have to manage and will gladly pay the per person monthly fee.

In order to give you a small snapshot of available options, I’ll outline five different systems that address the concerns outlined above. Each of these has their strengths and weaknesses, but what can be said for all is that they work, if you work with them. None are just for brokers or intermediaries, but in many cases, you can customize elements of the database and operations for your specific use.

Cloud-Based Solutions

Cloud-based systems are all subscription based, and charge users a fee based upon a cost per user/per month. As a sole practitioner, this may not be an issue, but if run a larger office, it may be. Over time, depending upon how you value the benefits being delivered, a cloud-based system can cost more than a stand-alone system.

With a cloud-based system though, as updates occur, you are provided them, and receive notifications of the updates and enhancements. No backup, infrastructure, or compatibility issues.

Does it work for large groups? Yes. In fact, one of the major benefits of a cloud-based service is its ability to scale. Cloud-based services are typically hosted in what is called a SaaS environment. SaaS stands for Software as a Service and allows the developer to offer the product benefits on an on-going recurring revenue basis. This helps fund continued operations, expansion to their infrastructure, enhancements, backups, etc.

Bottom line, if you are scared to death of IT and don’t know a backup disk drive from a flat panel LCD, then using a cloud-based CRM may be for you.

Here are two examples:

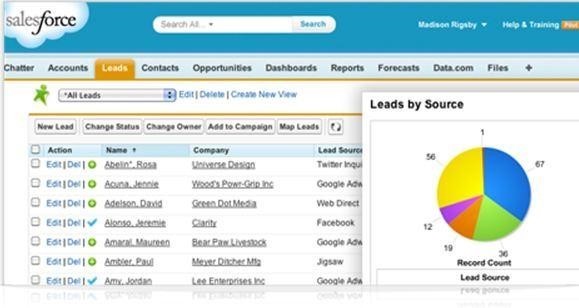

Salesforce/force.com (www.salesforce.com) – The most well-known of all the CRM systems, force.com offers a hands-off, totally integrated system. Based upon what information you want to store, it has different levels of use that give you greater capacity to customize your data, views, and operations. The cost for a force.com subscription can range from a basic offering at $5/user/per month to $250/per user/per month. A wide range, yes, but of course at the low end, all you get is a basic information repository, integration to Google Apps, and customizable reports. At the $65/per user/per month, which I believe most business brokers and intermediaries would find minimally acceptable to their needs, you get all the basic needs, plus opportunity tracking, templates for marketing, mass emails, campaigns, dashboards, analytics, racking products/services, etc.

Salesforce/force.com (www.salesforce.com) – The most well-known of all the CRM systems, force.com offers a hands-off, totally integrated system. Based upon what information you want to store, it has different levels of use that give you greater capacity to customize your data, views, and operations. The cost for a force.com subscription can range from a basic offering at $5/user/per month to $250/per user/per month. A wide range, yes, but of course at the low end, all you get is a basic information repository, integration to Google Apps, and customizable reports. At the $65/per user/per month, which I believe most business brokers and intermediaries would find minimally acceptable to their needs, you get all the basic needs, plus opportunity tracking, templates for marketing, mass emails, campaigns, dashboards, analytics, racking products/services, etc. The product gives you access to many important CRM features including (not an exhaustive list) functions like multi-language support, campaign management, response tracking, Outlook integration, dashboards, activity recording, and integration with server tools like Sharepoint (that will be of little value to you unless you run a Microsoft server) to share data between user over the net.

The product gives you access to many important CRM features including (not an exhaustive list) functions like multi-language support, campaign management, response tracking, Outlook integration, dashboards, activity recording, and integration with server tools like Sharepoint (that will be of little value to you unless you run a Microsoft server) to share data between user over the net.

Stand-Alone Systems

A lot of stand-alone systems exist (much more than I can cover here), and in some cases, the same software developer owns multiple CRM systems (Like Sage, which has 3). Stand-alone systems typically have equal or even more functionality than the cloud-based versions. Do you always need ALL the functionality delivered, likely no. But to some, just knowing it’s there to use without additional cost is a comfort. A number of the stand-alone systems also have cloud-based alternatives, so its pick what delivery method you like.

The biggest factor in choosing a stand-alone system vs. a cloud-based, as you will see in the examples, is price. In a cloud-based, subscription service, you are paying for use every month, like a lease. Over time, it can get expensive, especially when you have many users. Alternatively, a stand-alone system will have higher up-front costs, but get less expensive the longer you use them. Will you get monthly or quarterly updates (or more frequent) that a cloud-based service gets, no. But you have to consider the value of that to you.

Like a car lease, if you have a short lease and keep replacing the car every two to three years, you’ll have a perpetual cost and a new car. In the business brokerage and M&A field though, the need for bigger and better in relation to a CRM system is not the same thing as a car, and many brokers are content with the system they have, so on-going costs are always an issue that we want to control. In fact, I know of many brokers who purchase the upgrades to their existing CRM software once every few years as support for their current product twilights.

So, why doesn’t everyone use this approach if they plan on using their systems for greater than one year where it becomes more cost-effective to buy vs. “lease”? That’s because beauty is in the eyes of the beholder. Although ALL of these systems provide for and control the same basic functions the way the cloud-based systems do, the issues of initial costs (both hardware and software) and ongoing day-to-day requirements (like backup and support) can trump some of the cost benefits.

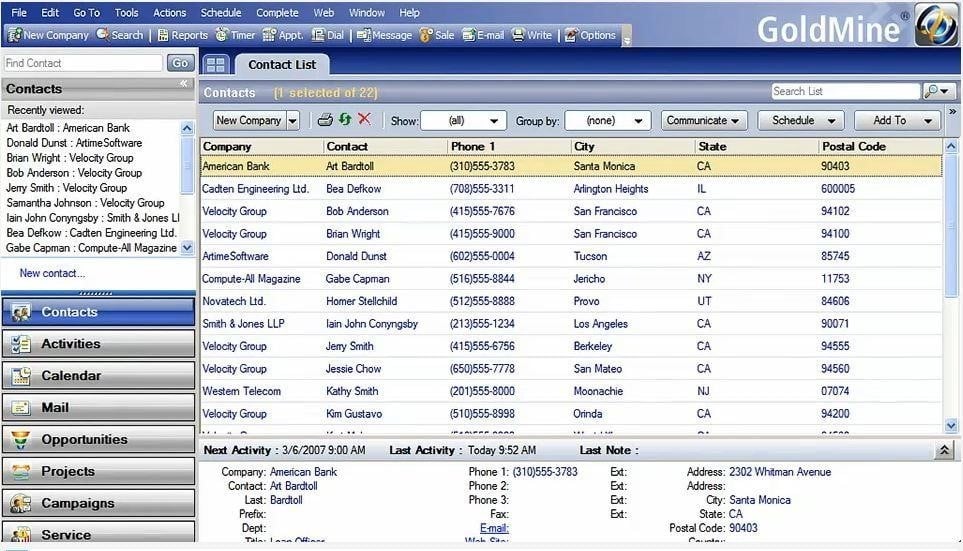

Here are three often used stand-alone CRM systems. Each of these are very established, require basic computer equipment you likely already have, and are not expensive either immediately, or over the longer term (many of these have a one-time cost that is the same you would pay for cloud-based services in just 6 months).

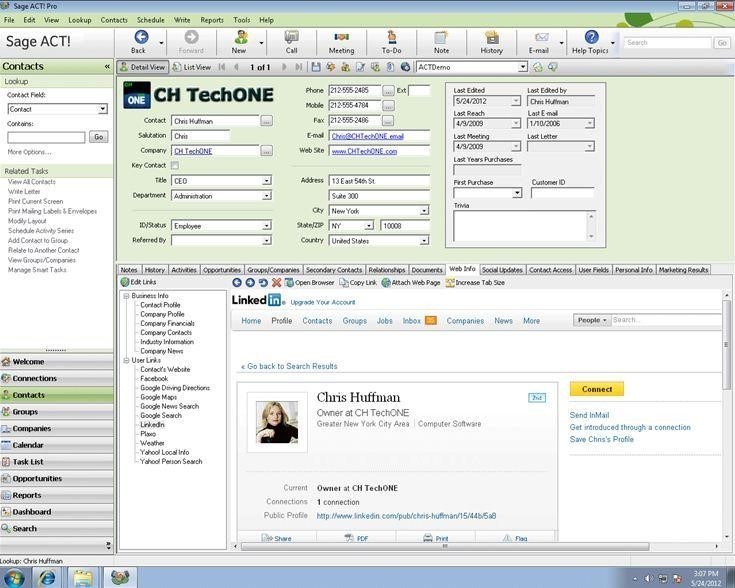

In a nutshell, there is little that Act! doesn’t do. It will handle recording all types of history, controlling personalized letters, to-do’s, meetings, appointments, opportunity management, relationships manager, integrated marketing system providing email and response tracking and analysis, social networking integration, mail-merging, field-level and user security, a very large network of third-party developers who add functionality to the product (both free and paid), and finally cloud access using special access if you buy the Premium for Web versions. It is fully customizable, so you can create new screens, and even use smart tasks to do things automatically for you.Does it do what you get in other, more expensive cloud-based systems? The short answer is yes. Act! costs about $595 one time per computer; there are no annual fees, monthly base per user fees, and there are discounts to be had that can lower the initial cost. If you want to use the advanced marketing functions, there is a small monthly fee. Other than that, there are no other fees unless you buy support plans (some people do, some don’t). If you like Act, you can also get it in an online cloud-based only format for a per user/per month fee like the cloud-based products above. Act! does update its systems at least once per year and offers upgrade pricing.Have a lot of users? Act also operates also in a terminal server environment, so you can buy say, four licenses, and if you have six people who want to access the CRM, but only, on average, three simultaneously, you can save money by buying a smaller amount of licenses and add more as required.What do you need to run it? Just a PC with an internet connection. For larger groups, a server should be investigated, but it is not a requirement.

In a nutshell, there is little that Act! doesn’t do. It will handle recording all types of history, controlling personalized letters, to-do’s, meetings, appointments, opportunity management, relationships manager, integrated marketing system providing email and response tracking and analysis, social networking integration, mail-merging, field-level and user security, a very large network of third-party developers who add functionality to the product (both free and paid), and finally cloud access using special access if you buy the Premium for Web versions. It is fully customizable, so you can create new screens, and even use smart tasks to do things automatically for you.Does it do what you get in other, more expensive cloud-based systems? The short answer is yes. Act! costs about $595 one time per computer; there are no annual fees, monthly base per user fees, and there are discounts to be had that can lower the initial cost. If you want to use the advanced marketing functions, there is a small monthly fee. Other than that, there are no other fees unless you buy support plans (some people do, some don’t). If you like Act, you can also get it in an online cloud-based only format for a per user/per month fee like the cloud-based products above. Act! does update its systems at least once per year and offers upgrade pricing.Have a lot of users? Act also operates also in a terminal server environment, so you can buy say, four licenses, and if you have six people who want to access the CRM, but only, on average, three simultaneously, you can save money by buying a smaller amount of licenses and add more as required.What do you need to run it? Just a PC with an internet connection. For larger groups, a server should be investigated, but it is not a requirement.

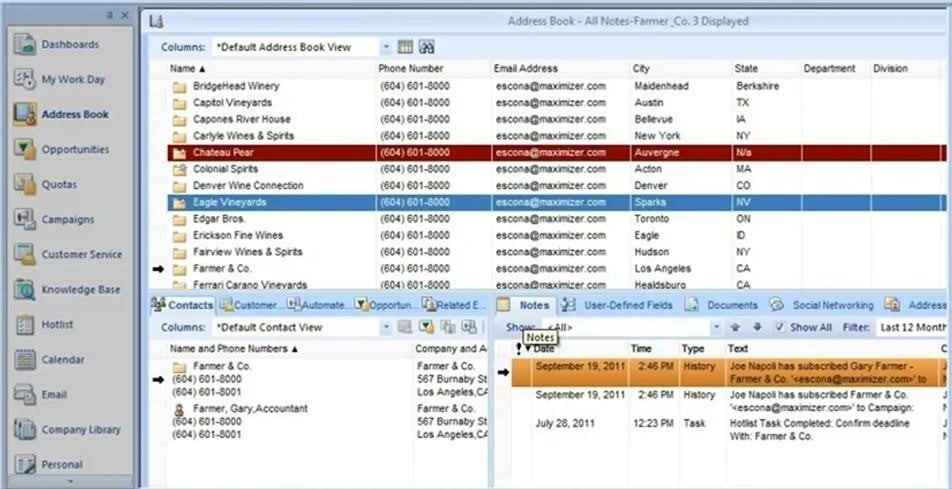

ptions (not that many brokers would utilize this), group calendars, and mass editing.Maximizer has different edition level

ptions (not that many brokers would utilize this), group calendars, and mass editing.Maximizer has different edition levelSummary

So, do you have a lot of choices? Yes. Can it be overwhelming? Yes. Is there a CORRECT answer? No. Since many of the CRM systems have many similar features, my opinion is that it comes down to two important factors; ease-of-use and price. You have to try some of the systems to see what you like, and make a determination of price based upon on-going costs.

In our industry, I’ve never met anyone who needs the latest and greatest every year. Have I heard from a ‘few’ brokers and intermediaries who wanted to keep their ongoing cost of operation down, yes.

Any of the systems shown will be more than adequate to handle the necessary requirements of a busy and growing business brokerage. Much of the value of a CRM is based upon what you load into it, how well you keep it up-to-date with records, and what you want it to do for you. As most people who use CRM’s will tell you, the system, as a repository of information and central hub to certain operations, increases in value to your organization each day.

What does my company use? We’ve used Act! since we started as a lean, and mean one-person shop. Now with over ten users, we still use it. Why? For one, it works. Also, because the transition to other systems would be timely and costly, and upon analysis, not provide incremental benefits that we don’t already have. Thankfully, Act! keeps getting better and we have updated our systems about four times in over ten years. Our cost has averaged to less than $100 per user/ per year. We have local, terminal server, and cloud-based access to our data 24/7, and last, we’ve customized the system to collect and control the data we need as intermediaries. Was it difficult? No, but it took some thinking and time. Now, it acts as the central hub for all of our data collection, marketing campaigns, and statistical analysis.

Would we better with other systems? I don’t know. But more to the point, I know we are realistic and satisfied with what we do have. That’s key. As you select a new system, or consider changing from your existing one, think about what value you will be achieving. A careful review of alternatives may reveal that what you currently use can be updated or enhanced just as easy to satisfy internal needs and helping to keep up with competition.

Have questions on the technology discussed over the last few months? We will shortly start a discussion group in the IBBA’s LinkedIn discussion area to answer any ongoing questions you do have. And, as always, please feel to call me or stop me at our next conference in June if you want to volunteer and help be part of the IBBA and M&A Source new ventures into technology!

Have a great month!

Marcie Woolworth, CBI, Fellow of the IBBA

“Professionalism is knowing how to do it, when to do it, and doing it.” – Frank Tyger

“Professionalism is knowing how to do it, when to do it, and doing it.” – Frank Tyger

Thank you all who participated in the membership survey! The results have been very enlightening, and we have a lot in motion. The Membership Committee is working on more benefits and resources for our members.

Be looking for your annual renewal notice around the beginning of November. After this renewal period, members will be able to renew by credit card on a monthly basis plus a small processing fee. We will also be switching to an anniversary date membership, where incoming members will have the renewal date of when they actually join.

Stay tuned for new and better benefits and resources!

Wishing you great success,

Marcie Woolworth, CBI, Fellow of the IBBA

Vice-Chair Membership Committee

Dora Lanza, M&AMI, CSBA, MEA

Twenty six years ago, as my husband George and I were having lunch, I proposed to him a crazy idea… quit your engineering job and come join me in what I do. His natural response, was obvious: “What? Give up a paycheck? Give up my senior executive position? And not to mention the perks? And what about the tension of working together?” But with my track record, it seemed like a great idea, after all, I had proposed to him and were happily married.

Twenty six years ago, as my husband George and I were having lunch, I proposed to him a crazy idea… quit your engineering job and come join me in what I do. His natural response, was obvious: “What? Give up a paycheck? Give up my senior executive position? And not to mention the perks? And what about the tension of working together?” But with my track record, it seemed like a great idea, after all, I had proposed to him and were happily married.

Making the mental adjustment from the corporate engineering world to the financial world was probably his biggest challenge. We are driven, dedicated, and hard working. The move proved to be very rewarding. After twelve years of mortgage banking and a couple of startup acquisitions, we decided that it would be more enjoyable to help business owners do the acquisitions and divestitures. So armed with our driven nature, we joined IBBA and took the fast track to getting our CBIs. With the knowledge behind us, we forged ahead, applying our past experiences and newfound knowledge.

This industry has been immensely rewarding. It allowed us to grow professionally and personally through the lasting and special friendships we established with colleagues while attending the IBBA/M&A Source Conferences and the educational opportunities they provide. The rewards have been un-measurable as there is no price tag to friendships. This prompted us to get involved in various committees and leadership roles.

There is no question that these past few years have had their toll in our industry. The economy impacted all of us, but from adversities and challenges, opportunities are born. As professionals, it causes us examine in detail every aspect of our practices: the good, the bad and the ugly and to concentrate on the strengths of our organization and make changes in the areas where we are not being fruitful. It is a changing world, a changing economy, but a very worthwhile industry. Just reflect back at all the financial statements you have recasted over your career as Intermediaries and you will agree with me: there are very few businesses that provide the prospects brokering does.

Our firm will be concentrating on increasing/evolving our marketing programs and developing our model grooming the next generation of M&A Intermediaries as we work with newly graduated MBAs.

In today’s economy, in order to obtain the engagements, we must view marketing as a strategy and an indispensable investment. Sellers are bombarded not just by local brokers, but by out-of-state firms as well. I can’t be the only one that walks in to an appointment with a possible engagement, only to find a seller complaining about the excess of e-mails from business brokers begging him for a meeting because they “have a buyer for their business.” Not to mention the file full of letters with the infamous quote: “Our buyers will pay you top dollar for your business,” I think not!

Our firm has a different business model. We focus on the importance of developing a minimum of ten sources of leads. In the end it is a numbers game, and a systematic and consistent approach will prove more successful.

Referrals are golden, and the most fruitful source of business leads consistently come from people and professionals with whom we have worked with in the past. And when considering “networking groups,” take on those where you can actively participate, either as part of a committee, or serving on a board.

Our approach consists of:

To weather the storm and excel, we need to view marketing as an indispensable investment and implement a systematic and consistent marketing plan that relies on multiple approaches and activities.

Before we implement each marketing activity, we remind ourselves of the best use of our time and talent to maximize the returns. But to have lasting effect, the key is in consistency. We love it when a business owner tells us, “I received your letter three years ago and now I want to sell my business”.

Ed Telling, Fellow of the IBBA

When asked why I became a business broker, my story starts when I left Cornell Business School in May of 1970 with my MBA. I headed to the President’s Financial Staff of General Motors, back when they were profitable, but bogged down with layers of management. I loved cars and wanted to change the world, but it was the wrong fit for me. After that, I finished up my military commitment at Fort Benning. The Vietnam War was winding down, so I took a summer job digging clams in the Great South Bay in Long Island, New York as an independent contractor.

When asked why I became a business broker, my story starts when I left Cornell Business School in May of 1970 with my MBA. I headed to the President’s Financial Staff of General Motors, back when they were profitable, but bogged down with layers of management. I loved cars and wanted to change the world, but it was the wrong fit for me. After that, I finished up my military commitment at Fort Benning. The Vietnam War was winding down, so I took a summer job digging clams in the Great South Bay in Long Island, New York as an independent contractor.

I returned to upstate New York where I did a ten year tour in the retail, wholesale, and commercial tire business. After that, I joined the VR Business Brokerage system. At the end of the five year agreement, I left to focus on the middle market in Upstate New York on my own. Now thirty years later, I am still going, still evolving, and still learning. See our website to learn more about us, www.TellingGroup.com.

I followed two super guys at IBBA, Darrell Fouts and Frank Beane. Tom West was a mentor and is still a very good friend. I wanted to become involved in the IBBA and M&A Source, but I knew from Jeff Jones the time and focus needed to help an organization grow. Your business practice can suffer a lot if you are not careful in allowing time for the things that are important. Jeff worked hard building both TABB and then IBBA, so I was well aware of the risk and time commitment.

As an officer of the M&A Source, I witnessed the membership grow from maybe forty to one hundred forty. My son grew up thinking a couple of hundred people around the country liked him so much they sent him presents (if he did not have a hundred teddy bears I would be surprised). At three months, Barbara West and Connie Womack took over being “super grandmothers” to Edward III and continue to this day. My world revolves around my wife and my son, then the brokerage practice, and then some close friends around the US that I have met through the IBBA.

Given what happened in the last four years, I procrastinated on developing new programs, but now have developed “The Gold Apple Program” that will be out October 15, 2012—with a target of seller’s worth from $10 -75 Million. Our retainer will be $65K, then later next year a $100K option comes out nonrefundable, with a fee of five percent (that is if I am bold enough and good enough to handle it). My dream has been to have five clients from $5-10 Million in value, then fifteen from $10-75 million in value. I think life will then be good. This will generate action, and action begets action.

The TGL Family Business Program will roll out during the first quarter of 2013, which is what we have done most of over the years but this will brand it, formalize it, and give it focus in the marketplace. TGL tries hard to improve and adjust, but keep a focus on our core beliefs: top service is worth the money, don’t take on a project for the wrong reasons or work with the wrong people, just go back to work and find the best fit. Market and sell and do it with class. Let me make it clear it has not always been a smooth ride. We have made and continue to make mistakes. We reinvest in us, our team of twelve, and our business so we can evolve to a better operation and life. Barbara West said to me that often business brokers don’t invest and don’t innovate- I would like that never to be said of us.

What advice do I have for other business brokers? Work, never quit, understand who you are (and who you are not), and be true to your core values. Then work some more! Get to know the best and brightest of the current generation. I am old and I know it. Having restarted in the martial arts after eleven years, I understand what old is, but we will endeavor to grow, to learn, and to get better. My recommendations are to learn, get to know the best in the industry with which you can talk, share your thoughts and concerns with others. Study and think out of the box. All businesses have risks. Figure out how you deal with them and keep moving!

Am I able to touch on and comment on some of the risks? Fear of going broke, being humbled, and being stiffed for a fee are just some of the risks business brokers have to contend with. But, if you do what you are supposed to do, then the collective win for your client, your team, your family and yourself is a successful closing, and an instant “YES, I can.” But then go back to work. Oh, by the way, having a pipeline of deals is the best way to success.

Gary Papay, CBI, M&AMI, CMEA

I grew up in a small town in Pennsylvania, where my extended family owned a slate quarry business. At the age of 13, I went to work part time at the slate quarry on Saturday mornings and during summer vacations. My parents and grandparents never intended for us “kids” to remain in the family business but instead wanted us to go to college and get a “good” job after graduation. Little did I know at the time the invaluable experience working in a family business would prove to be my future career choice.

I grew up in a small town in Pennsylvania, where my extended family owned a slate quarry business. At the age of 13, I went to work part time at the slate quarry on Saturday mornings and during summer vacations. My parents and grandparents never intended for us “kids” to remain in the family business but instead wanted us to go to college and get a “good” job after graduation. Little did I know at the time the invaluable experience working in a family business would prove to be my future career choice.

Upon graduating from college, I went to work for a large northeastern petroleum/propane distributorwhere our major growth strategy was through acquisitions. For the next 18 years, I moved nine times and learned all about the petroleum/propane business including valuations, acquisitions, and eventually divestitures. Then in 1994, at the ripe old age of 40, my wife and I found ourselves a company headquarters in Syracuse, NY with our three little girls, a record snowfall, and our parent company in financial trouble forcing the petroleum/propane division to divest of assets to raise capital. Aside from the snow being over our girls’ heads, something was wrong with this picture.

That spring, I was lucky enough to run into two semi-retired gentlemen who were doing valuation and M&A work in the petroleum and propane industry on a part time basis. One of the partners was looking to retire, so I finally got the courage to leave the corporate world and joined the group. The remaining partner served as my mentor over the next five years until I purchased the firm in 1999.

It was during these early years on my own that I stumbled across the IBBA in the Kiplinger Washington Letter. I had no idea there was an actual industry and an association dedicated to business brokerage and M&A activity. I immediately joined and attended my first conference in San Diego in the fall of 1997. Some of you old timers might remember Bob Gurrola’s karate demonstration and our exclusive night at Sea World in San Diego.

I think what has impressed me most about the IBBA and M&A Source over the years is the quality of the education programs and the networking opportunities with many experienced business brokers and M&A Intermediaries. There is this camaraderie among our members who openly share their experiences and ideas to help make you more successful in your own practice. I rarely miss a conference where I always pick up an idea or two that I can put to immediate use which more than offsets the price of the attending the conference.

I would like to encourage all members to get involved in their association by joining a committee and volunteering for leadership positions. It’s true what they say, “the more you give the more you receive.”

Clyth MacLeod, Lifetime CBI

Who is Buying Businesses in New Zealand?

Who is Buying Businesses in New Zealand?

Businesses have different values to different buyers. The only true test of value is a sale on the open market. It is where the willing buyer meets the willing seller. Today, we have four different types of buyers:

Yes, there are many other types—more women buyers, “baby boomers” seeking independence, older buyers looking for a second or third career. And many are just “buying a job”. Buyers and sellers of businesses will benefit from dealing with experienced specialist business brokers who understand that it is not just the figures that drive value.

“Cashies” – a no-no!

Sometimes when listing a business the owner suggests there are cash benefits that do not show on the financial statements – some revenue not banked, staff paid “under the table,” or company-paid expenses that are not strictly necessary for the production of income. We really don’t want to hear this!

We cannot (and will not) quote this to prospective purchasers. The owner has told us that he (or she) is dishonest. They are defrauding the taxman, and ultimately their fellow citizens. And, if caught they could face harsh penalties. No one likes taxes but they are necessary to keep the country running.

The silly thing is that it is not really a bright thing to risk. We had a prospective vendor recently who started to claim he did not declare $100,000 income last year. If he did, he saved paying some $33,000 in tax. If he had declared it his profit for the year would have been $100,000 more and the value of the business would have increased by over $360,000 tax-free!

And if he really did take out that much cash from the company how did he spend it? There is a limit to how much you can drink and eat. But when you spend it on cars, boats, and travel, the IRD can check your possessions against your declared income.

As always, honesty pays.

Where the Battles and Tactics Occur to Put Deals Together

This section is available for members to share their recent successes, unique deal situations, and strategies employed to successfully close a transaction. Names of the participants can be masked to provide confidentiality. Please email your write-up to [email protected], and we will feature in in our next newsletter. Please limit your comments to 500 words.

Keith McLeod, CBI

This year under the leadership of Pino, Chet, and your board, a new company was selected to manage our Association—Meeting Expectations in Atlanta, Georgia. It has been a positive experience and has provided added value to our organization. This year Meeting Expectations was named as one of the city’s best places to work for the second consecutive year. Congratulations to Karl, Lynne, and their team.

This year under the leadership of Pino, Chet, and your board, a new company was selected to manage our Association—Meeting Expectations in Atlanta, Georgia. It has been a positive experience and has provided added value to our organization. This year Meeting Expectations was named as one of the city’s best places to work for the second consecutive year. Congratulations to Karl, Lynne, and their team.

Check with our regular columnists Steve, Marcie, and Scott. Steve continues his valuable insight selecting the software to make you more efficient. He should group his articles in a booklet and make it available to members for a fee. Scott’s periodic survey represents real value to our associates and Marcie is announcing new membership plans.

Yiannis Empeoglou is a Greek CBI member of our Association. He has just written a book, How Much is Your Business Worth? If you have a Greek client you may want to pick up a copy through Amazon or email Yiannis at [email protected]. Our New Zealand member Clyth MacLeod returns to add his monthly wisdom.

In our Member Spotlight we feature Dora Lanza. She discusses the strategy and approaches she and her husband use to achieve success. Members should consider duplicating their approach. However, I find the richness of her comments sharing with us the story of her and her husband. George said, “Yes!” and launched a new career – lucky for George and the IBBA/M&A Source.

Veteran Ed Telling, who played an early and prominent role launching our M&A Source, discusses his past activities, and present plans for his new program for the future.

Here are some valuable visibility tips, questions and food for thought from my mentor Alan Weiss:

This week’s focus point: We bring back mementos from our vacations that remind us of great times and explorations. Sometimes we realize later that they are actually inexpensive and common, but they still serve the purpose of reminding us, which is the real value. What “mementos” do you keep at hand to remind you how much value you bring to others, how much success you’ve enjoyed, how rich and full your life is? You should love to go on vacation, and then love to come home. You should love to go about your career, and then love to “come home.” What is apparent in your life daily that you can see, feel, and appreciate to remind you that you are effective, intelligent, successful, and someone others need to talk to? One thing travel tells us: We’re better off than we think.

IN THIS ISSUE: “Embracing Our Legacy, Shaping Our Future” Letter from the 2024 IBBA Chair. Plus, Insights on Finding Success, Overcoming Blindspots, the Latest Legislative Update, and more!

Independence, OH May 21st, 2024 – IBBA, the world’s largest professional trade association for Business Brokers, today announced and recognized the recipients of its top performance awards at the 2024 Annual Conference in Louisville, Kentucky. “The cumulative transaction value of this year’s submitted deals was over $2 billion, which is an astounding number,” stated Kylene […]

Independence, OH – April 11, 2024 – The International Business Brokers Association® (IBBA) is pleased to announce the inaugural inductees to the IBBA Hall of Fame: Jim Afinowich | Lifetime Master CBI, M&AMI, Fellow of the IBBA Pino Bacinello | Lifetime Master CBI, M&AMI, CM&AP, Fellow of the IBBA Barry Berkowitz | Lifetime Master CBI, M&AMI, […]

Newsletter Sign UpGet the latest insights on buying and selling small businesses direct to your inbox.