IBBAinsights: Summer 2024

IN THIS ISSUE: “Embracing Our Legacy, Shaping Our Future” Letter from the 2024 IBBA Chair. Plus, Insights on Finding Success, Overcoming Blindspots, the Latest Legislative Update, and more!

LOU VESCIO, IBBA CHAIR

As I come to the end of my term as Chairman of the IBBA, I am grateful for the opportunity to serve the best business brokers in the world and all that I have learned from some of the smartest and hardest working people in the business. After many years in this business and having met thousands of business brokers, I often reflect on what makes some people so great in this business! The answer came to me while watching a football game recently.

As I come to the end of my term as Chairman of the IBBA, I am grateful for the opportunity to serve the best business brokers in the world and all that I have learned from some of the smartest and hardest working people in the business. After many years in this business and having met thousands of business brokers, I often reflect on what makes some people so great in this business! The answer came to me while watching a football game recently.

Whether you are a fan of the New England Patriots or not, most people that watch the game know that Tom Brady, the New England Patriots quarterback, is one of the best in the business. Unfortunately, Tom was not always considered to be “so great.” Out of the 254 players drafted in the NFL in 2000, Tom was selected as the 199th pick. As a 7th round draft pick, his chances of playing on a team for more than two years was less than 50%, and the odds of remaining on a team for more than five years was about 10%. In fact, the average career for quarterbacks is only 4.4 years. So, what propelled Tom to move from the 199th pick in 2000 to one of the best quarterbacks in the league’s history, five Super Bowl wins, sure bet to make the NFL Hall of Fame, and still playing at the top of his game after 17 years?

The answer is practice and education! Tom is known to work 16 hours a day practicing and studying the game. He studies playbooks for both offense and defense, watches game films, studies individual players for their strengths and weaknesses, and devotes himself to the game and his team.

So, what makes a great business broker great? The answer is the same, practice and education! All the great business brokers I have met work hard at their practice and learn as much as they can about the business. By earning the CBI designation, a broker takes the first big step to become great. By attending additional IBBA and M&A Source classes is the next step to becoming great. By participating in IBBA and M&A Source conference workshops and webinars is yet again another step. By collaborating with other, more experienced, business brokers in closing transactions is yet again another big step. By being aggressive, working hard, and searching for great listings is the required hands-on experience that helps hone the necessary skills to make a broker truly great! Becoming one of the best in the field does not just happen overnight! It takes a Tom Brady like focus to move to the top of the heap, and the IBBA and M&A Source are here to help its’ members achieve that status.

Once one’s skill sets, knowledge and experience reach a certain level, the next boost in learning comes from creating webinars, workshops and courses for the IBBA to share one’s knowledge and experience with others. The best way to learn a subject is to teach it! When required to create educational content, the creator must learn everything about the subject and be able to discuss all the issues, both favorable and unfavorable, and that is when the most learning takes place.

As we approach the end of 2017, I want to thank you for letting me serve as your Chairman. Our Board of Directors, our dedicated and hard-working Committee Chairs & Members, and the great staff at allyAMC have accomplished a great deal this year, and the plans for next year are even better.

Beginning on January 1, 2018, I will be passing the gavel to Warren Burkholder, one of the smartest and hardest working members that I have met during my many years in the IBBA. Warren, is truly one of the “Tom Brady’s” of the IBBA, and I know he will help take the organization to even greater levels.

It has been a real privilege serving our members as the Chairman of the IBBA, and I hope you all have a great Holiday Season and a very Happy New Year! Make 2018 the year you become one of the “Tom Brady’s” of business brokerage.

Continued success,

Lou Vescio, CBI, M&AMI, Fellow of the IBBA

DAVID MADISON

The SBA has released rule changes that are scheduled to go into effect on January 1, 2018. Big changes are coming that will have a direct impact on how your deals can and cannot be structured. This article is the first of our series that will tell you what you need to know so that you can take advantage of the opportunities while not falling into unforeseen traps that can derail your transactions.

The SBA has released rule changes that are scheduled to go into effect on January 1, 2018. Big changes are coming that will have a direct impact on how your deals can and cannot be structured. This article is the first of our series that will tell you what you need to know so that you can take advantage of the opportunities while not falling into unforeseen traps that can derail your transactions.

The SBA rules revisions cover lots of ground, and most of the changes are technical or institutional in nature. We’ll move past those and examine just the changes that will impact you and your transactions:

The rules look simple. But, each lender will then have to integrate the SBA’s rules with their lending policies, and that is likely to create confusion on all fronts. This will probably cause the failure of some good transactions that should otherwise be successfully closed and funded.

We strongly believe that it is vital to control your transactions and the financing process, and this will be even more the case as the new rules come into play. Lenders will be driven more than ever to structure your transactions to suit their needs. Don’t let them. We expect to see lots of case-by-case lending that creates policy on the fly. That can be either good or bad, depending on who the players are and how that process is controlled. Borrowers going to banks directly as a “one-off” will be the prey of the lenders, even more than they are now. On the other hand, respected intermediaries with solid, high volume on-going relationships will be in the best position to shape things properly. As always, we’ll partner with you to build a structure that works for your buyer and seller and then we’ll bring in one of our lenders who will do the loan our way.

Now an important point that we alluded to above… The revised rules cover just the SBA’s minimum requirements. Those are the rules that everyone must follow at a minimum. The lenders then apply their own credit policies on top of the SBA’s rules. Lender credit policies can match or stricter than the SBA’s rules, but never softer or less demanding. This distinction, between rules and credit policies is one that must be fully understood by everyone in a deal. If not, it is bound to create great confusion and disappointment.

We have already started talking with our lenders about the new rules and how they may adjust their credit policies in response. We expect to see a fair amount of inconsistencies even within how individual lenders respond on a case-by-case basis, with many lenders clamping down on their deal structures and becoming more conservative. We also believe that intermediaries who bring a large volume of high quality loans to their lenders will be in the best position to deliver to their clients the best, most advantageous deal structures that come as close as possible to the SBA’s new rules.

Now that we’ve set the broader context, let’s get into the new rules. The first thing you’ll see is that the focus is strictly on the buyer’s equity injection. Seller notes no longer count towards the minimum equity requirement unless the seller is willing to wait until the buyer fully pays off the SBA loan (and we don’t expect to see a whole lot of that happening). Two things to note here:

The above is loaded with potential opportunities for a lender to structure your deal. Or should we say “strangle” your deal instead? We’ll get into those questions in our upcoming newsletters.

Let’s wrap up with a simpler change but one that may still lead to challenges:

Note the term “project cost” or “total project cost.” A buyer’s equity injection typically used to be based on the selling price of the business. “Project cost” can be found in the current SOP’s but seems to be rarely used. Going forward, it will be the basis for determining the required equity injection in pretty much every transaction.

Project cost is the sum of the price of the business, plus working capital, plus closing costs including the SBA guarantee fee. Seems straightforward. But here’s the rub – – when the buyer looks to the lender to add an abundant amount of working capital into the loan, that request will come with a corresponding larger equity injection requirement. It may not be a concern for some buyers, but it will be for the many who are coming into the deal without extra cash to invest into the transaction. We’ll help your buyers navigate this so that they end up with the best possible outcome with this important deal structuring element.

As you can see, there is a lot going on here. We’ll be working hard with our lenders to better understand and help shape things as the new rules go into effect in the coming weeks. If you are working on a transaction and aren’t sure how the new rules apply, please give us a call and we’ll be happy to help you. And, make sure to check out our upcoming newsletters as we dive deeper into all of this and explore how you can get more of your deals successfully closed.

David Madison is a Business Finance Consultant at Diamond Financial Services. With both a successful career as a lender and small business owner, David brings a unique perspective to each of their clients and their transactions. He is passionate about small business ownership, gaining his greatest professional joy when helping clients move from the W-2 world to the independence and fulfillment that can only come from owning and succeeding in their own businesses. Through his work at Diamond Financial, David is excited to be partnering with the IBBA professional community, helping them increase their transaction closure rates and making small business ownership a reality for their clients. David can be reached at 919-376-2919 or [email protected].

The Listings you missed in 2017

Wednesday, December 13, 2017

12 pm EST

In this webinar, Aaron Thom of Peak Development, will be describing all the ways brokers leave money on the table. Industry reports say business development is one of the hottest subjects currently in our industry, likely because most brokers only use a couple channels of business development to find their next listings. Aaron will review the business development channels in our industry and talk about what are the most powerful ones, if you only can do a couple. Studies prove business owners are in many channels and if you’re a broker that’s only utilizing a couple business development channels, you could be leaving listings on the table.

JONATHAN BRANDOW

Every business broker understands that establishing yourself as a trusted advisor and correctly pricing a listing are among the most critical elements to a sale—and that valuation analytics are the key to smart pricing.

Every business broker understands that establishing yourself as a trusted advisor and correctly pricing a listing are among the most critical elements to a sale—and that valuation analytics are the key to smart pricing.

But numbers can do much more than help bring your listing into the competitive pricing arena. Clearly presented, easily understood industry market analytics can also intrigue your prospects, provide them the comfort they need to take the next step—and even entice them to improve an offer.

Here are three examples:

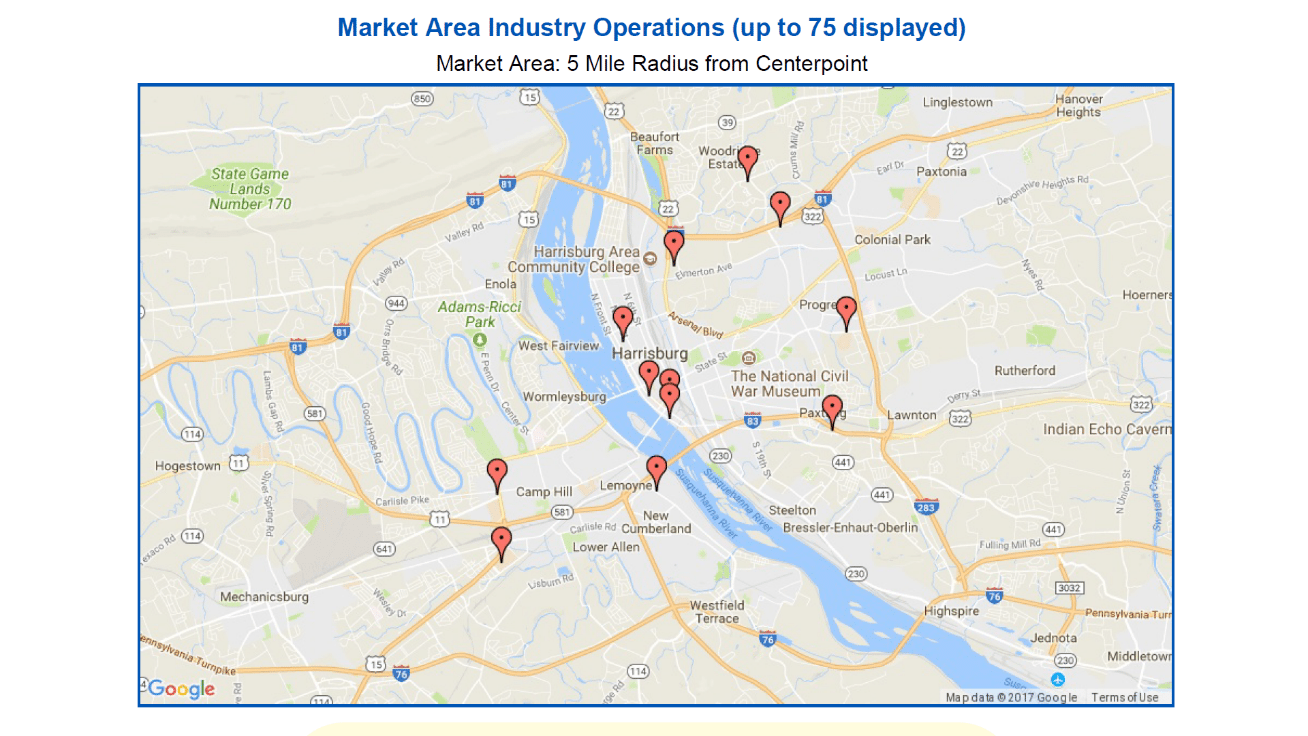

1. Show Them You Know the Lay of the Land

Use analytics to assure your prospect that you understand the competitive environment. A competitor count and map, the total market volume of the listing industry in its defined area—and for main street listings, the small business share of that market—go a long way toward convincing the buyer that you know what you’re talking about when it comes to the listings that interest her.

Use analytics to assure your prospect that you understand the competitive environment. A competitor count and map, the total market volume of the listing industry in its defined area—and for main street listings, the small business share of that market—go a long way toward convincing the buyer that you know what you’re talking about when it comes to the listings that interest her.

Legacy competitor counts (about two years old) can be gleaned without cost from the Census Bureau’s County Business Patterns—if your listing’s market area encompasses a complete county or metro area and aligns with one of several hundred industries that may be offered.

BizMiner’s Market Snapshots for Business Brokers offers highlights of significantly more robust assessments of competitors and market volume for 9000 industries in any market radius, zip or larger areas, and includes co-branded reports you can share as teasers, fold-ins for your CIM or even publish on your web site.

Of course, a buyer might be interested in more than market size and share. BizMiner’s Market Penetration metrics (Sales per Person, Sales per Household) note and quantify any gaps in the local industry market relative to US norms.

In the example shown here, coffee shops in downtown Harrisburg, PA lag national Market Penetration metrics by $1.6m-$2.3m, suggesting significant growth opportunities for the industry overall. Accompanying market area population and income demographics in the BizMiner Snapshot back up the opportunity for that growth.

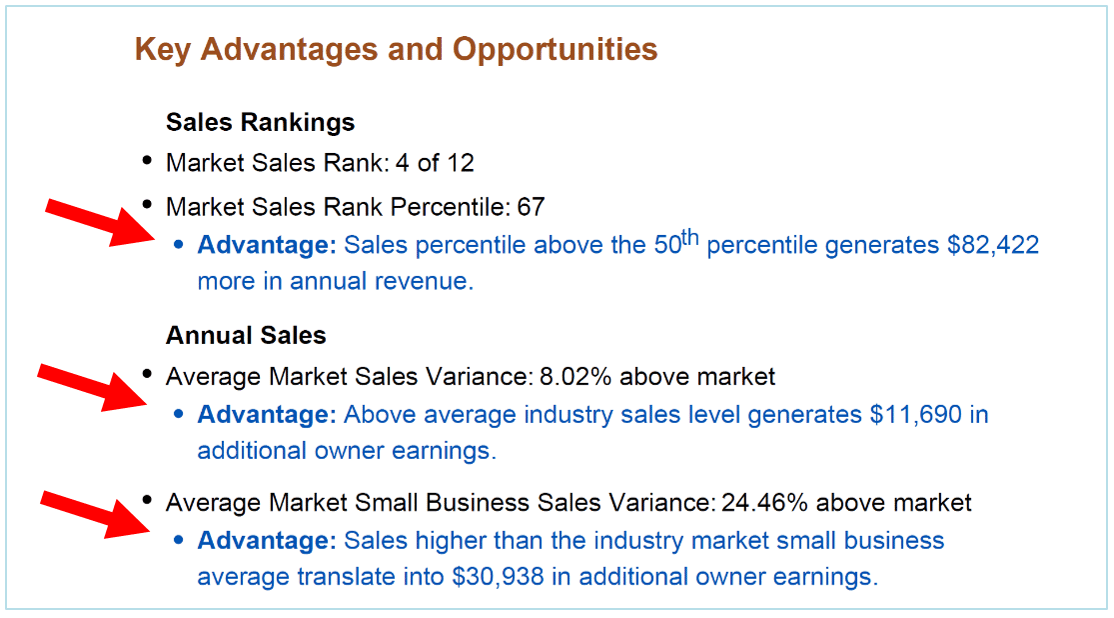

2. Position the Listing’s Market Advantages

There’s nothing a buyer likes more than evidence that a listing is a solid, well-positioned player in its industry market. The buyer doesn’t want platitudes about the national popularity of coffee shops; she wants to know what the local competitive market looks like and how the listing is situated within it. That’s not easy data to find, but BizMiner has it. So why not build confidence with hard numbers that show that your listing’s sales rank above the industry average or small business or top the median? Most important, BizMiner Snapshot advantages are quantified in every case, displaying how much more the listing sells or earns than the average industry firm in the same market.

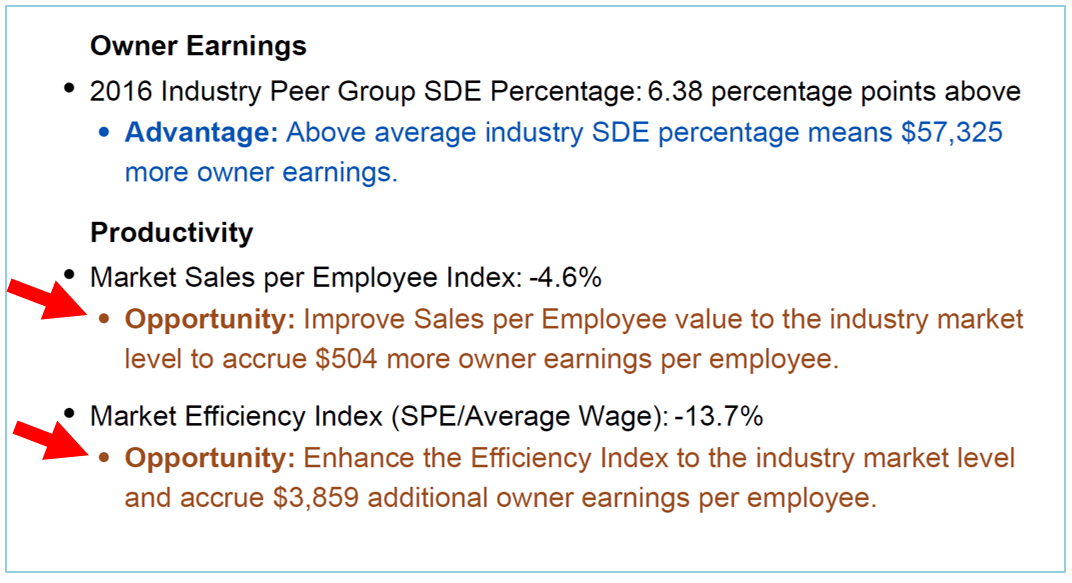

3. Intrigue Prospects with Easy-to-Grasp Growth Opportunities

But what about lagging metrics? How can you deal with data that shows your listing falling behind? Turn disadvantage into easily understood opportunity. Lagging sales? The BizMiner Snapshot shows how much higher sales would be if the purchaser could only take your listing to the average level.  Lower than average SDE? Show your prospect how much more cash he would pocket if he could just raise the SDE percentage to the industry average. Inefficient operations? The Snapshot quantifies the added cash-in-pocket to the new earner if efficiency is just elevated to average levels, or if the net profit percentage were to reach the industry levels.

Lower than average SDE? Show your prospect how much more cash he would pocket if he could just raise the SDE percentage to the industry average. Inefficient operations? The Snapshot quantifies the added cash-in-pocket to the new earner if efficiency is just elevated to average levels, or if the net profit percentage were to reach the industry levels.

You Know Your Prospect Best

One prospect may want only the comfort of good news. Another is excited by the challenge of turning around a business that may have some problems but also presents opportunity. A third might want to see only the barest information—too much at once might cause confusion.

Only you can make that final call what to present, to whom and when. That’s why the BizMiner Market Opportunity Snapshot for Business Brokers makes it easy to toggle each metric on or off. Include the metrics that work for your prospect, filter those that should wait for another time.

Access to Data You Can Trust

The key point is that this data is accessible to brokers now at no—or very reasonable—cost.

The 2015 industry counts and total employment data is available online from County Business Patterns without charge. Market area and industry classifications may be limited.

The more detailed and timely Bizminer Market Opportunity Snapshots for Business Brokers are refreshed monthly and cost as little as $6 per Snapshot.

Would you invest $6 in material that is solidly researched yet flexible enough to customize your approach to the needs of various prospects for a single listing? That targets the specific industry and market area occupied by your listing? BizMiner offers exactly that for 9000 industry options in any US radius, zip code, county, metro state or national market. Access a free white labelled sample and see for yourself?

Jon Brandow is the founder and principal at BizMiner, the exclusive provider of financial and industry market data services to the International Business Brokers Association. BizMiner provides analytical industry content to 30,000 bankers; thousands of accounting, valuation, CRE professionals and consultants; and over 200,000 business students in almost 100 universities.

MICHAEL FEKKES, CBI, M&AMI

Business Brokers and M&A Advisors who are members of the International Business Brokers Association are recognized as being part of the most prestigious business brokerage association in the world. Most members have made significant investments in furthering their knowledge, expertise, and trade craft through participating in the variety of education, training, and industry best practice events, facilitated by the IBBA. Many members have achieved the Certified Business Intermediary designation, identifying them as having met the highest standards for education, ethics and professionalism. (The CBI credential is now even more respected as three sell side transactions must be completed by candidates applying after the 2018 conference going forward to obtain the designation). Some professionals have enhanced their resume further by taking on leadership positions within the IBBA or obtaining credentials and certifications from complimentary organizations.

Business Brokers and M&A Advisors who are members of the International Business Brokers Association are recognized as being part of the most prestigious business brokerage association in the world. Most members have made significant investments in furthering their knowledge, expertise, and trade craft through participating in the variety of education, training, and industry best practice events, facilitated by the IBBA. Many members have achieved the Certified Business Intermediary designation, identifying them as having met the highest standards for education, ethics and professionalism. (The CBI credential is now even more respected as three sell side transactions must be completed by candidates applying after the 2018 conference going forward to obtain the designation). Some professionals have enhanced their resume further by taking on leadership positions within the IBBA or obtaining credentials and certifications from complimentary organizations.

Business intermediaries who are active and fully utilize the considerable resources available through the IBBA, recognize the skills and expertise they receive and the value this intellectual property and market intelligence brings to prospective clients in the marketplace. Being the foremost authority in the acquisition and sale of small businesses has tremendous value and therefore, the services we provide as trusted advisors, should not be given away for free.

While the M&A and Business Brokerage industry is competitive, like most industries, it is still surprising that so many practitioners give away their intellectual property. Representing businesses for sale without receiving an upfront fee, is a poorly devised approach. The majority of business brokers have structured their compensation only in the form of a success fee, paid at closing, upon the sale of a business. This structure does not recognize the considerable work that is performed by a business broker and does not incorporate the stakeholder mentality, that requires a client to have skin in the game and a commitment, in the form of fee payment, to complete a sale at the terms discussed. When a client makes a financial investment in the broker, they will have more respect for the advisor’s time and are more likely to respond quickly to the myriad of document and data requests necessary for the intermediary to close the transaction. We have all received things for free in our lifetime. The results and effort put into these “free endeavors” is not commensurate with those that require a financial investment.

Few outsiders understand the significant amount of time that we spend and the required skills it takes to execute the considerable tasks necessary to achieve a successful transaction. While real estate might be involved, we are not real estate agents. Business Intermediaries are retained to negotiate the best price, terms, and conditions for the sale of a privately held businesses. We perform opinions of value and produce confidential information memorandums; we develop custom marketing strategies and discreetly qualify prospective buyers, all in the best interest of our clients. In a perfect world, all businesses we represent are sold. But from a practical perspective this is not the case.

Some geographic regions have restrictions on the type of fee(s) that can be charged. Incorporating such fees in these markets will require brokers to utilize different wording or terminology in the representation agreement so that these regulations are followed. Of course, there will always be exceptions and instances where the upfront fee might have to be modified or waived. For those situations where the client is adamant about not paying the fee upfront, we have found they will often accept this fee being paid on the back-end, a scenario which will increase the broker’s compensation. As with any negotiation, someone should be willing to give something in return for receiving a concession. There is no better place for a broker to demonstrate their negotiation skills to a client, than during the listing agreement phase.

The larger point of this article is the understanding that If we start our relationship with our clients by giving our services away for free, because we may feel uncomfortable with asking for an upfront fee, what message are we sending to our clients? We should be demonstrating our expertise to the seller and our capability of generating the maximum value for their business through the negotiation of our own representation agreement. The IBBA provides all the tools, resources, education opportunities, and access to colleagues with decades of experience, who selflessly share their pearls of wisdom and best practices. Yes, anyone can work for free, but it is often the most experienced and capable individual/firm that receives remuneration for these services (up front). These are the firms and individuals that achieve the same respect as attorneys, CPA’s, and wealth managers. We are compensated on the intellectual property, experience, and skills we have accumulated. Savvy business owners understand and respect this.

I was fortunate to have this ‘listing fee’ concept instilled in me nearly a decade ago when I affiliated with Jeff Snell at ENLIGN. Personally, it has been very successful and I would endorse the fee upfront approach to all IBBA members. Yes, the market is competitive, but instead of a race to the bottom (who will do more for less), I want to work with clients who recognize and value the IBBA education, experience, and skills that I utilize on their behalf, by making a small financial commitment up front.

Michael Fekkes is a Senior Broker at ENLIGN Business Brokers in Nashville, TN. Michael is a Merger & Acquisitions Master Intermediary [M&AMI], Certified Business Intermediary [CBI], Chairman of the International Business Brokers Association [IBBA] – Communications Committee, as well as a former business owner. He can be reached at910.691.2202 or [email protected]. –ENLIGN Business Brokers is a Professional Services Firm serving the Southeast that is headquartered in Raleigh, NC providing business intermediary services ranging from valuation and sale to exit & succession planning strategies.

DARREN MIZE, A.S.A.

It’s not uncommon to see one or more family members of the owner of a small business (whether they are shareholders or not) working or assisting within the operation in some capacity. Some may work more hours than others and some may not work at all but still draw a salary. So, when it comes to calculating discretionary cash flow how do you treat these individuals?

It’s not uncommon to see one or more family members of the owner of a small business (whether they are shareholders or not) working or assisting within the operation in some capacity. Some may work more hours than others and some may not work at all but still draw a salary. So, when it comes to calculating discretionary cash flow how do you treat these individuals?

The Purpose of Normalizing Cash Flow

To normalize cash flow, you are removing items that are a benefit to the owner(s) or that the business does not need to operate (revenue or expense) on a day-to-day basis. These include typical owner benefits such as W-2 compensation, interest expense, auto, travel, insurance, rent (paid rent normalized to market rent), as well as non-cash items like depreciation, and amortization. You will hear terms like one-time expense (computer upgrades, legal fees associated with lawsuits, etc.), or more generic terms like “operating” or “non-operating” since normalizing cash flow requires separating the operating from the non-operating. Add all this up and you get what is referred to as Seller’s Discretionary Earnings or SDE, which is the primary cash flow stream used in pricing small businesses.

To normalize cash flow, you are removing items that are a benefit to the owner(s) or that the business does not need to operate (revenue or expense) on a day-to-day basis. These include typical owner benefits such as W-2 compensation, interest expense, auto, travel, insurance, rent (paid rent normalized to market rent), as well as non-cash items like depreciation, and amortization. You will hear terms like one-time expense (computer upgrades, legal fees associated with lawsuits, etc.), or more generic terms like “operating” or “non-operating” since normalizing cash flow requires separating the operating from the non-operating. Add all this up and you get what is referred to as Seller’s Discretionary Earnings or SDE, which is the primary cash flow stream used in pricing small businesses.

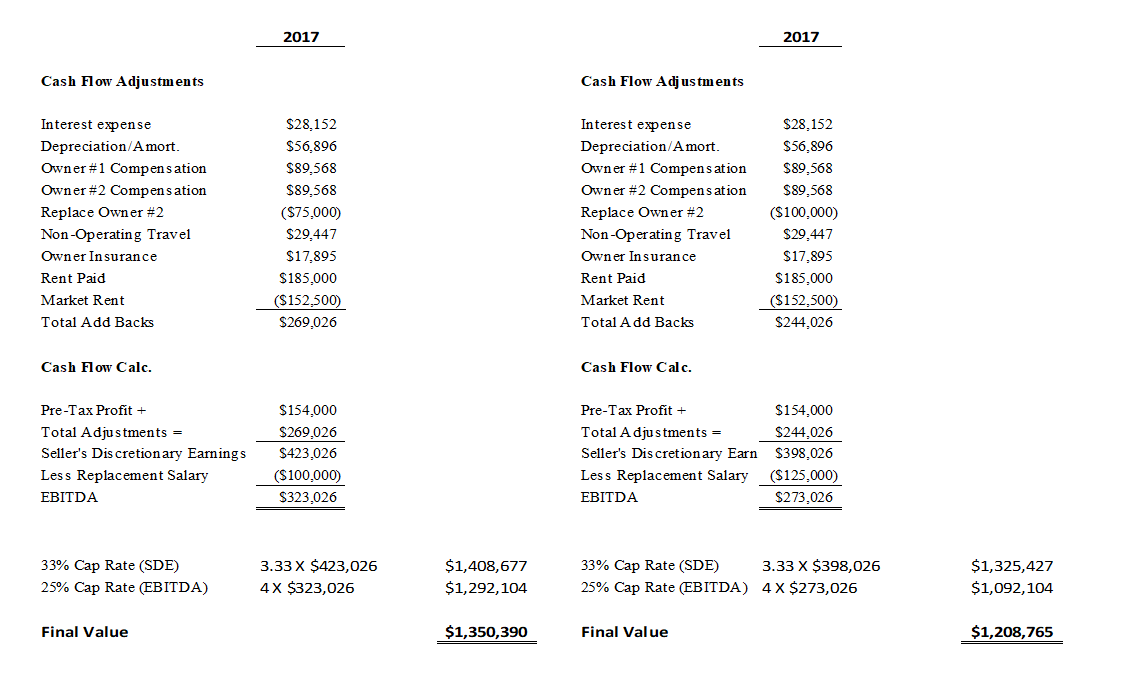

SDE v EBITDA

After calculating SDE, there is one more adjustment to consider: normalizing the owner’s responsibilities. Because SDE includes owner’s compensation, it reflects cash flow available to a hypothetical buyer before he/she pays someone to manage the business. To properly calculate EBITDA, (Earnings Before Interest, Taxes, Depreciation, and Amortization) you must deduct a replacement salary from SDE to account for the owner. Generally, EBITDA becomes more of a factor when a business generates more than $500K in SDE; but calculating EBITDA is still a key component to valuing a business.

Replacing More Than Just the Owner

When there is only one owner working full-time and managing the business, you only need to account for the owner’s replacement salary, but what if there are other shareholders, family members, or friends working within the operation – how do you normalize those positions? First, it’s important to identify what responsibilities these individuals (other than the owner) have and their respective W-2 salaries. All W-2 salaries are added back to your cash flow calculation and then based on their responsibilities, corresponding replacement salaries for each of those individuals must be deducted from your cash flow calculation before SDE can be calculated accurately.

During this process you might find multiple people doing the same job, (positive to cash flow), where other positions are not being paid enough, or at all (negative to cash flow). Regardless, paid or not paid, each active position must be accounted for to calculate SDE accurately.

Determining the Right Replacement Salary

Adjusting for an active position within a company requires that replacement salary to reflect market compensation. Market compensation reflects: the position, industry, region, and to some degree, the level of contribution to the company (i.e. part-time vs. full-time). It is always important to consult with the owner or anyone else who has a decent understanding of the job market for a particular area or industry when it comes to selecting an appropriate market replacement salary for a specific position. Using employment publications, Bureau of Labor Statistics, or industry trade magazines are other good sources of market data. Regardless, the market salary must have some relevant data behind it to support the figure.

Absentee Owner

The valuation of a privately held business will always assume that a hypothetical buyer of that company will become an owner /operator and become its General Manager. So, what happens when the owner is not active in any capacity and relies on a General Manager to manage the operation? Under the assumption of an owner / operator managed business where the existing owner is absentee, the GM position becomes discretionary to a new hypothetical owner. In this case, your calculation of SDE will include any W-2 compensation paid to the owner as well as to the GM. Assuming the GM is not a shareholder, the replacement salary used to calculate EBITDA will be equal to the existing GM’s salary, as this is an accurate reflection of market based compensation. If the GM and owner are related in some capacity, it’s best to research market-based salaries to meet the GM’s responsibilities and use that as your replacement to calculate EBITDA.

Getting it Right

Below is a basic calculation using different replacement salaries to determine the value of a business using both SDE and EBITDA calculations. The calculation assumes a 33% Cap Rate on SDE and a 25% Cap Rate on EBITDA.

It may seem trivial, but replacement salaries are a critical step in accurately valuing any privately held business. Replacement salaries do have a material impact on value and it’s certainly not uncommon to see someone manipulate the value of a business by using a higher or lower replacement salary. By ignoring positions, you can overvalue a business; on the converse, lofty or highly paid positions without normalization can undervalue a business. It is always best to get it right.

Darren Mize is an Accredited Senior Appraiser (ASA) at GCF Valuation, Inc. with more than 20 years of business valuation experience. GCF Valuation is a full-service business valuation firm based out of Tampa, Florida and Darren’s role as Partner and Senior Appraiser of the Firm’s M&A Division is to provide valuation consulting services to the Firm’s merger & acquisition and business intermediary clients involved with buy/sell transactions of privately-held businesses.

[ezcol_1half]

113 new members since September 1, 2017!

The IBBA Family has grown to 1,160 Total Members!

[/ezcol_1half][ezcol_1half_end]

Calling all IBBA members! For the entire month of December, enjoy 30% off all IBBA University courses! View our course list HERE

[/ezcol_1half_end]

[ezcol_1half]

The 2018 Spring Educational Summit will be held in Cleveland, Ohio March 11 – 13 and will offer courses #210, #220, and #221. Registration is open now!

[/ezcol_1half][ezcol_1half_end]

The 2018 IBBA Annual Conference will be held in New Orleans, LA on May 4 – 7! Register now and join us for The Awards Dinner, The Main Street Marketplace, Workshops, Masterminds, Courses and more.

[/ezcol_1half_end]

IN THIS ISSUE: “Embracing Our Legacy, Shaping Our Future” Letter from the 2024 IBBA Chair. Plus, Insights on Finding Success, Overcoming Blindspots, the Latest Legislative Update, and more!

Independence, OH May 21st, 2024 – IBBA, the world’s largest professional trade association for Business Brokers, today announced and recognized the recipients of its top performance awards at the 2024 Annual Conference in Louisville, Kentucky. “The cumulative transaction value of this year’s submitted deals was over $2 billion, which is an astounding number,” stated Kylene […]

Independence, OH – April 11, 2024 – The International Business Brokers Association® (IBBA) is pleased to announce the inaugural inductees to the IBBA Hall of Fame: Jim Afinowich | Lifetime Master CBI, M&AMI, Fellow of the IBBA Pino Bacinello | Lifetime Master CBI, M&AMI, CM&AP, Fellow of the IBBA Barry Berkowitz | Lifetime Master CBI, M&AMI, […]

Newsletter Sign UpGet the latest insights on buying and selling small businesses direct to your inbox.